Consumers today want whatever they want whenever they want it. The demand for instant gratification has seeped into every corner of our lives, especially e-commerce, with 97% of shoppers calling faster delivery critical to their purchasing decisions.

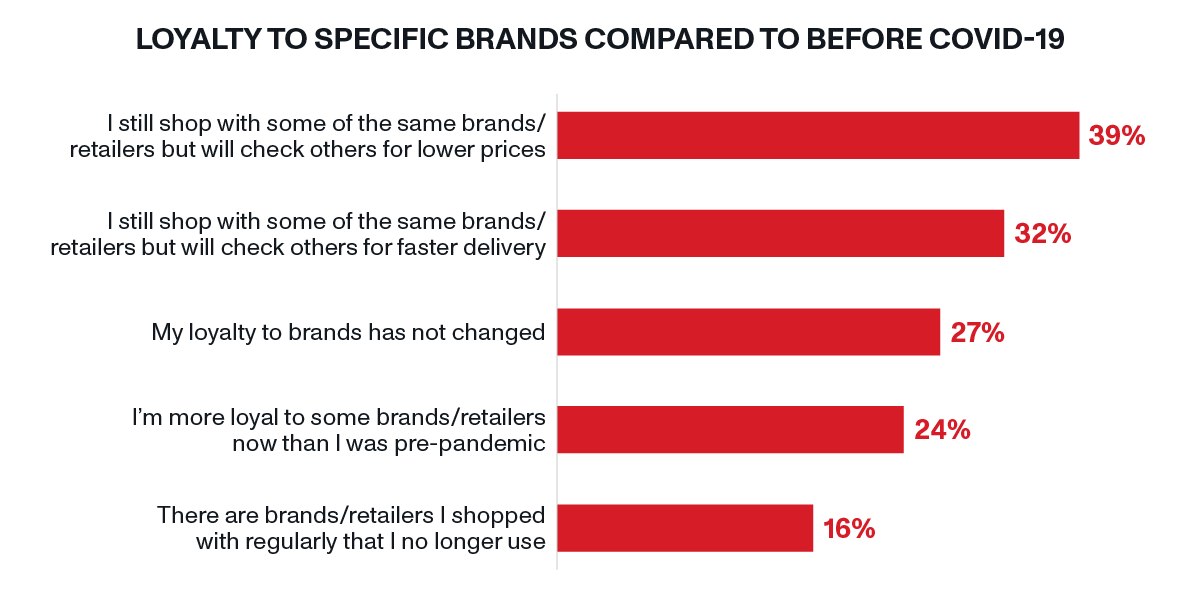

When the COVID-19 pandemic accelerated the shift from in-store to online shopping, factors like speed and the convenience of home delivery became consumers’ top priorities. As shoppers began to seek out retailers that could meet these demands, almost 40%—mainly Gen Z and Millennials—fully deserted brands they previously trusted for new ones, leading to a broad disruption in brand loyalty.

Even as we move into the post-pandemic era, many of the impacts are proving to be long-lasting—and that includes the growing demand for faster delivery and the lack of brand loyalty among shoppers. Only 61% of consumers are still loyal to businesses they used prior to the pandemic, and even those that still shop with brands they used pre-COVID will check other retailers for lower prices (39%) and faster delivery (32%).

How can retailers rebuild brand loyalty in today’s brand-agnostic climate? OnTrac surveyed more than 5,000 consumers over the last three years to understand their shopping preferences and purchasing behaviors. Here are some of the key trends we uncovered, as well as how retailers can bridge the gap between the delivery experience they’re providing and what consumers are expecting.

How can retailers rebuild brand loyalty in today’s brand-agnostic climate? OnTrac surveyed more than 5,000 consumers over the last three years to understand their shopping preferences and purchasing behaviors. Here are some of the key trends we uncovered, as well as how retailers can bridge the gap between the delivery experience they’re providing and what consumers are expecting.

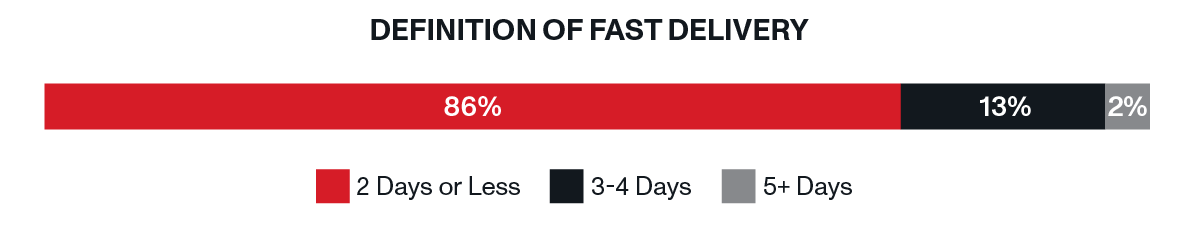

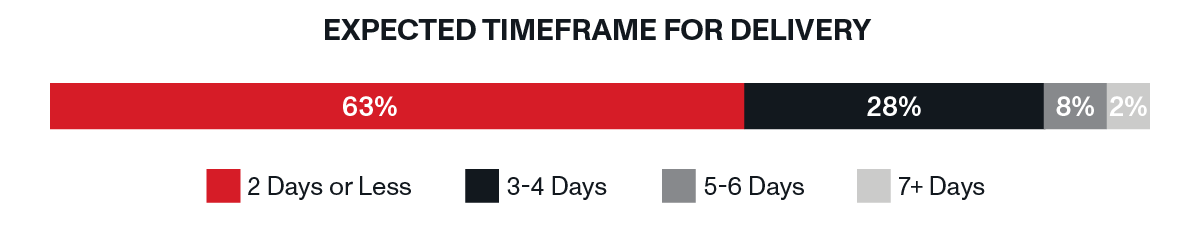

1. 63% of Consumers Expect Two-Day Delivery

Consumers have made their demands for faster delivery clear, but just how quickly do they expect to receive their items? Eighty-six percent of consumers define fast delivery as two days or less and 63% expect to receive their items within this timeframe. This turnaround time remains the expectation for orders with free shipping, with more than one-third (39%) of consumers that place an order without shipping fees claiming they will only accept deliveries that arrive in two days or sooner.

2. Slow Delivery Loses Customers

2. Slow Delivery Loses Customers

While faster delivery is helping retailers attract more customers, slow delivery is driving them away. Seventy percent of consumers consider slow delivery to be three or more days after placing their order. Retailers that fail to meet the timeframe that consumers have come to expect are losing business. In 2023 so far, slow delivery has caused 63% of consumers to switch retailers, 60% to not purchase again from a retailer, and 43% to abandon their carts or stop shopping with that retailer. Shoppers also chose one retailer over another due to the availability of next-day (71%) and same-day (67%) delivery.

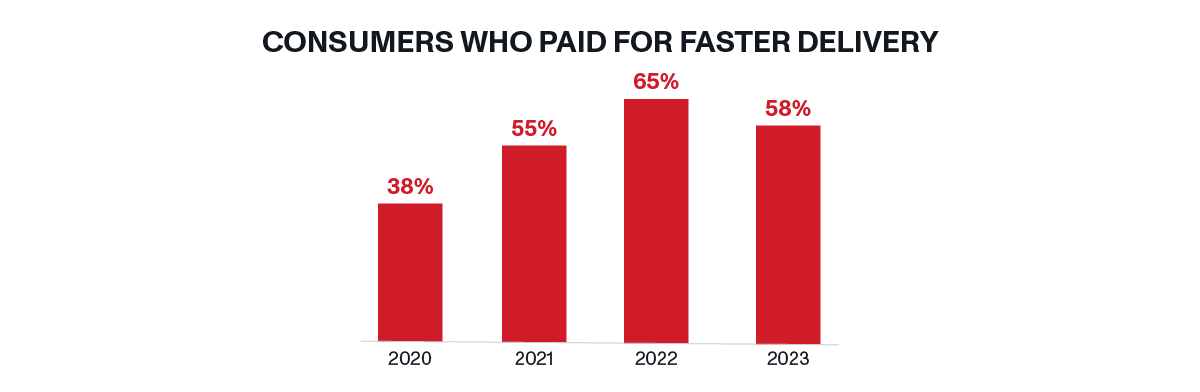

3. 69% of Consumers Are Paying More for Next-Day Delivery

3. 69% of Consumers Are Paying More for Next-Day Delivery

Shoppers are increasingly gravitating to retailers that provide faster delivery, and they are willing to pay for it. Nearly 60% of consumers have paid extra for faster delivery in 2023 so far, with the majority having paid more for next-day (69%) and same-day delivery (61%). Compared to just 38% of shoppers that paid for expedited delivery in 2020, that’s a massive 53% increase in just a few years.

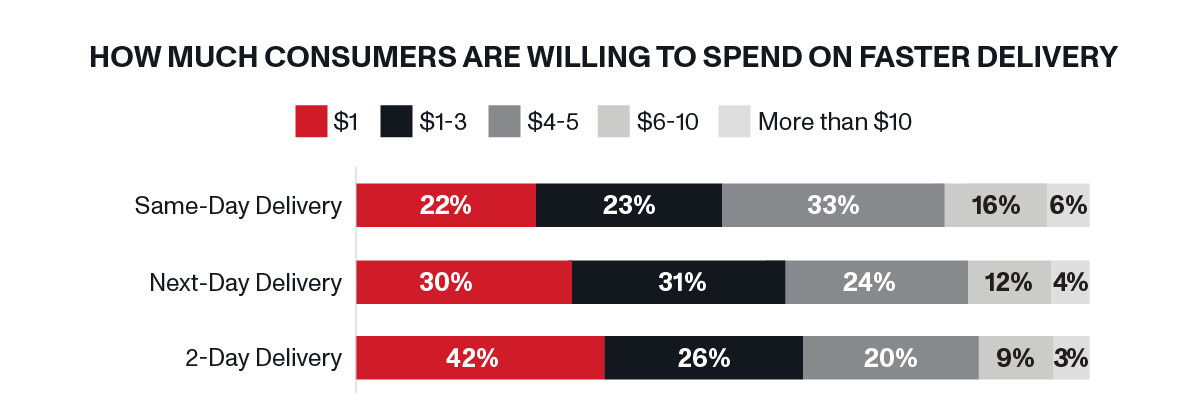

When it comes to how much shoppers are willing to pay for faster delivery, 71% of consumers would spend at least $3 for next-day delivery, while 55% would spend $5 or more for same-day delivery.

When it comes to how much shoppers are willing to pay for faster delivery, 71% of consumers would spend at least $3 for next-day delivery, while 55% would spend $5 or more for same-day delivery.

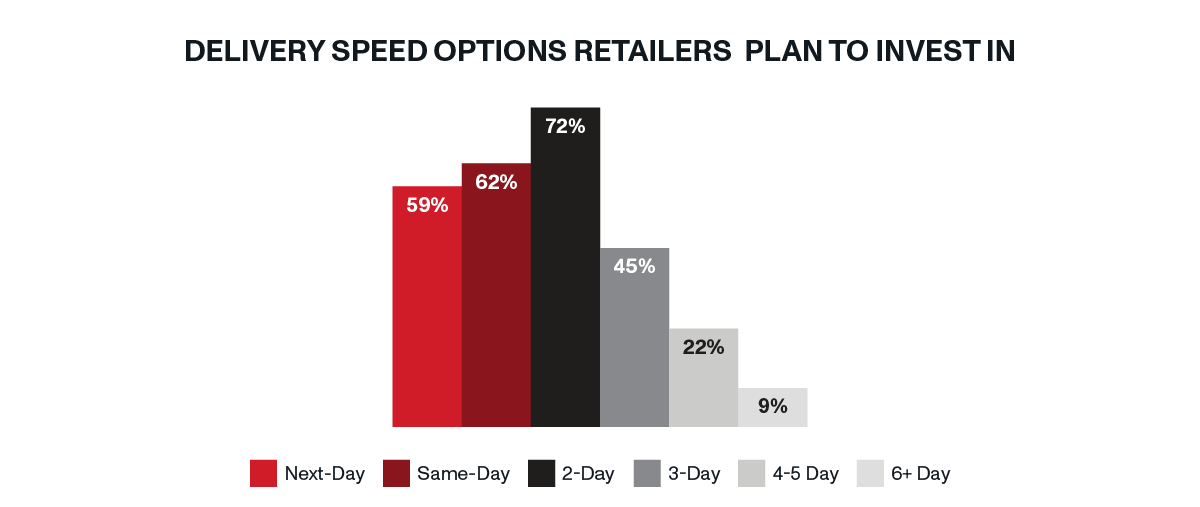

How to Leverage Faster Delivery to Rebuild Brand Loyalty

As consumers increasingly prioritize faster delivery when shopping online, retailers are leveling up their shipping strategies to get items to their customers as quickly as possible. OnTrac surveyed over 150 supply chain executives from leading omnichannel retailers and found that almost 60% aim to use faster delivery as their primary differentiating strategy, with nearly three-quarters planning to invest in two-day delivery over the next two years. This is a huge jump from the only 57% that currently offer two-day delivery on orders with free shipping and demonstrates how seriously retailers take the value of speed to consumers.

As retailers work to rebuild brand loyalty through faster delivery, many are diversifying their carrier mixes. Compared to national carriers, alternative carriers provide faster delivery, more flexibility, cost-savings, and greater support. Retailers have increasingly relied on alternative carriers since the start of the e-commerce shift, with 89% currently leveraging alternative carriers. Sixty percent of retailers surveyed chose to use alternative carriers due to faster delivery, with another 36% indicating they were influenced by cost savings.

While carrier diversity can help retailers differentiate themselves from the competition and win back customers, it is imperative to note that not all carriers are created equal and there is a risk of over-diversification. According to project 44, retailers on average used a record high of 6.17 last-mile delivery carriers in June.

In order to rebuild brand loyalty and win customers, retailers should partner with a proven alternative carrier that can provide the best combination of faster delivery, cost-savings, geographic coverage, and on-time performance.