The e-commerce acceleration has altered consumer behavior and expectations, while also creating tremendous opportunities for retailers. Even as Americans wrestle with high inflation, 83% of consumers plan to increase or maintain their online spending levels in 2023 and beyond, as shown in Exhibit 1.

Exhibit 2 outlines the reasons why, with consumers citing free shipping as their primary motivation, followed by convenience, product availability, and faster delivery as key factors.

Exhibit 2 outlines the reasons why, with consumers citing free shipping as their primary motivation, followed by convenience, product availability, and faster delivery as key factors.

Though consumers have clearly indicated their shopping preferences, many retailers have been slow to adapt to these changing behaviors, leading to a decline in brand loyalty. How can retailers respond to these opportunities and best position themselves to capture greater share of wallet?

Though consumers have clearly indicated their shopping preferences, many retailers have been slow to adapt to these changing behaviors, leading to a decline in brand loyalty. How can retailers respond to these opportunities and best position themselves to capture greater share of wallet?

OnTrac partnered with Hanover Research to survey more than 5,000 consumers over the last three years to understand how their shopping behaviors and preferences have shifted and what factors drive their online purchasing decisions. The results cast a spotlight on how consumers define fast delivery and how this impacts where they shop, the value of speed and consumers’ willingness to pay for it, the continued importance of free shipping, and the growing demand for home delivery.

In this whitepaper, we will dive into the key takeaways and offer actionable recommendations to help retailers build supply chains that meet shifting consumer demands, win customers, and build brand loyalty.

Key Takeaways

- Consumers Expect Deliveries Within 2 Days When Shopping Online

- Faster Delivery Matters and Customers are Paying For It

- The Demand for Home Delivery Is Growing

- Free Shipping Remains Critical Amid Inflation

Consumers Expect Deliveries Within 2 Days When Shopping Online

In today’s economy, instant gratification has become the expectation. The demand for immediate results is seeping into every corner of our lives, particularly e-commerce, with 97% of consumers calling faster delivery an important factor in their purchasing decisions.

So what speed are consumers expecting?

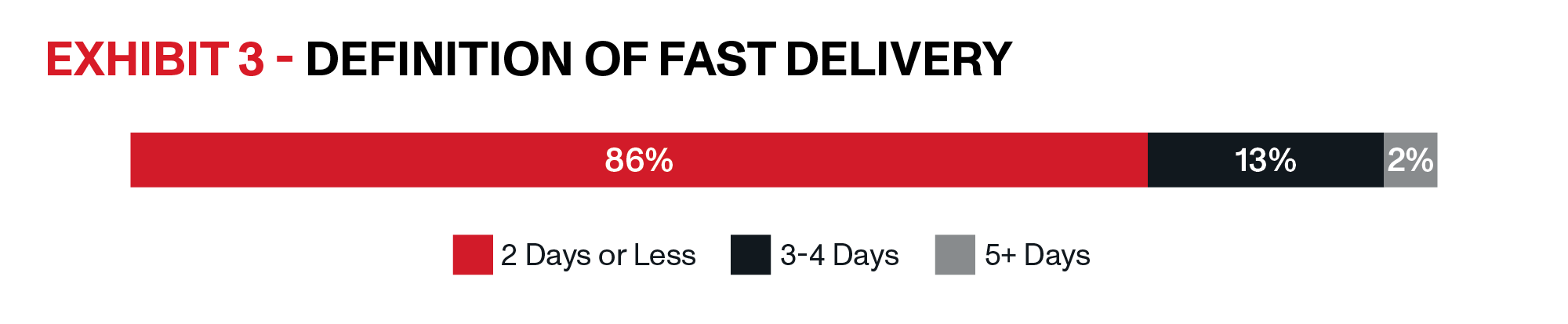

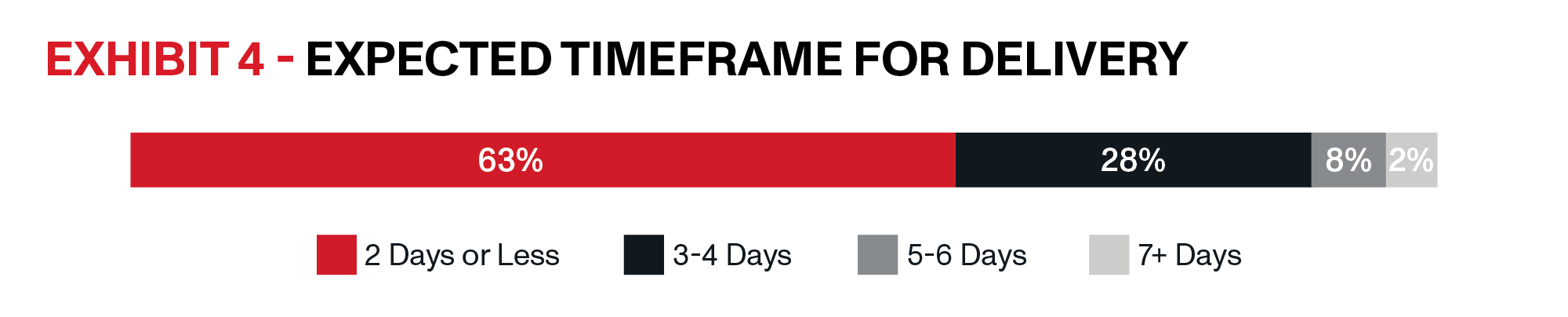

Eighty-six percent of consumers define fast delivery as two days or less and 63% expect to receive their deliveries within this timeframe, as shown in Exhibits 3 and 4. Many shoppers demand this same caliber of delivery speed no matter what, even if a retailer offers certain benefits like free shipping. Additionally, more than one-third of consumers (39%) that order an item with free shipping are not willing to wait longer than two days.

Delivery speed also plays a key role in consumers’ participation in loyalty programs. Of those that joined a loyalty program to get faster delivery, 83% consider an acceptable delivery time to be within two days.

Delivery speed also plays a key role in consumers’ participation in loyalty programs. Of those that joined a loyalty program to get faster delivery, 83% consider an acceptable delivery time to be within two days.

While faster delivery is helping retailers capture more share of wallet, slow delivery is driving customers away and causing retailers to lose business. Seventy percent of consumers consider slow delivery to be three or more days after placing their order, and they will shop elsewhere to receive their items faster. Exhibit 5 shows that slow delivery caused 63% of consumers to switch retailers, 60% to not purchase again from a retailer, and 43% to abandon their carts or stop shopping with that retailer.

These findings emphasize how much consumers value faster delivery and how it drives their purchasing decisions. Failure to provide the level of speed that consumers are demanding will result in a loss of brand loyalty, severely impacting retailers’ bottom lines and causing them to fall behind the competition.

These findings emphasize how much consumers value faster delivery and how it drives their purchasing decisions. Failure to provide the level of speed that consumers are demanding will result in a loss of brand loyalty, severely impacting retailers’ bottom lines and causing them to fall behind the competition.

Faster Delivery Matters and Customers are Paying For It

Consumers are increasingly choosing retailers with faster delivery when shopping online, and more are demanding the option for next-day and same-day delivery. These two options have overwhelmingly led consumers to make a purchase online rather than in-store, as shown in Exhibit 6. At the same time, the majority of consumers chose one retailer over another due to the availability of next-day (71%) and same-day (67%) delivery.

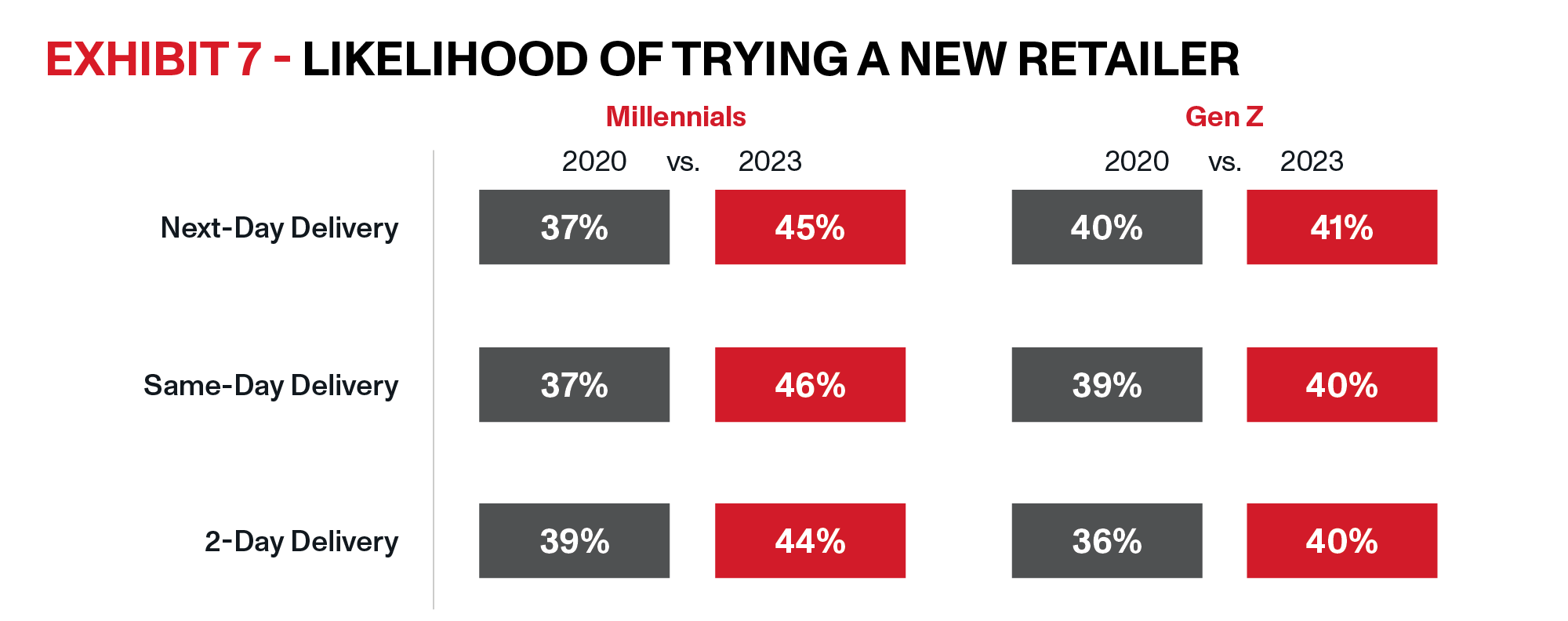

Having grown up in the digital era, delivery speed is especially important to younger generations. Faster delivery is the top consideration for Gen Z and Millennial consumers when shopping online, and Exhibit 7 reflects the growing influence of next-day and same-day delivery on where they choose to shop compared to before the pandemic.

Having grown up in the digital era, delivery speed is especially important to younger generations. Faster delivery is the top consideration for Gen Z and Millennial consumers when shopping online, and Exhibit 7 reflects the growing influence of next-day and same-day delivery on where they choose to shop compared to before the pandemic.

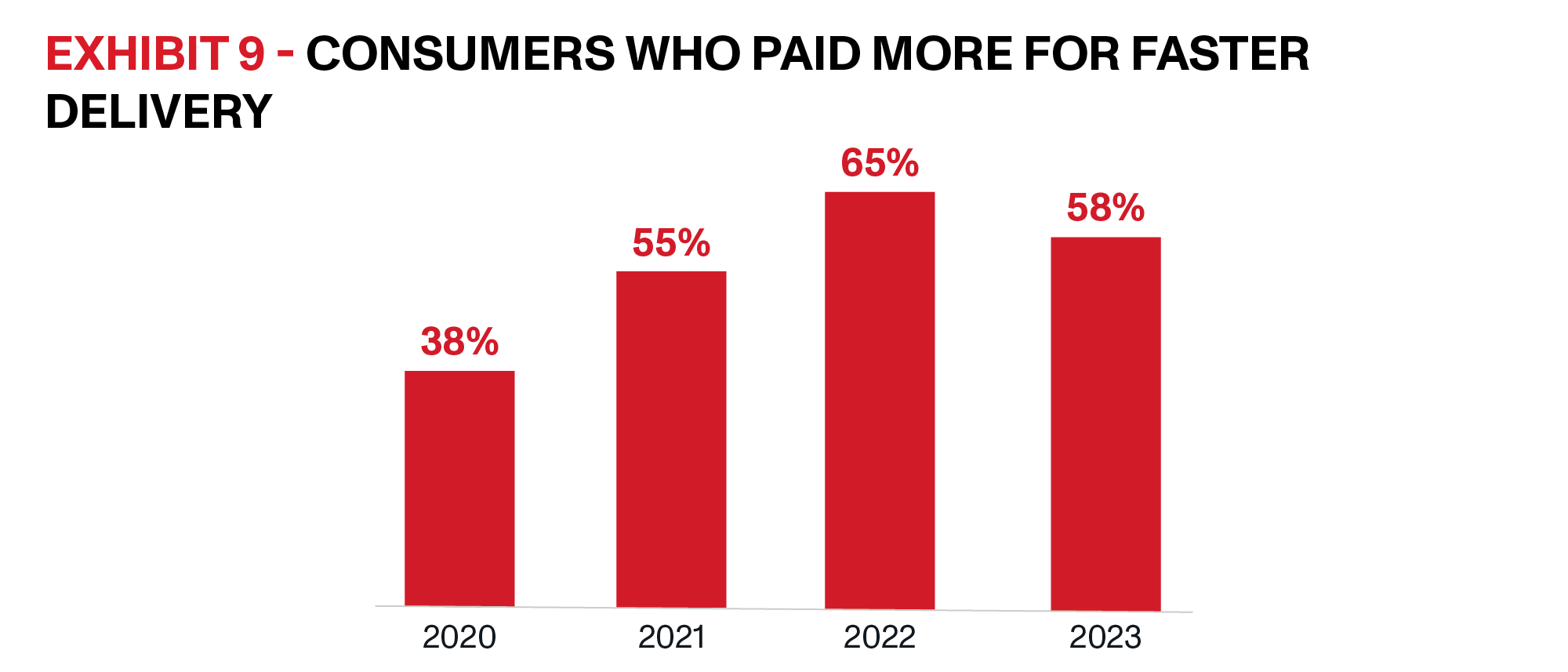

Not only is delivery speed driving purchases, but consumers are paying to have their items delivered faster. Fifty-eight percent of consumers have paid more for faster delivery in 2023 so far, with two-thirds of those having paid more for (69%) next-day delivery and same-day delivery (61%), as shown in Exhibit 8. These findings are particularly compelling and reflect the evolution of consumers’ shopping behaviors, as 62% of those surveyed in June 2020 had never paid for expedited delivery. Exhibit 9 highlights this 53% jump in consumers who paid for faster delivery over the last few years.

Not only is delivery speed driving purchases, but consumers are paying to have their items delivered faster. Fifty-eight percent of consumers have paid more for faster delivery in 2023 so far, with two-thirds of those having paid more for (69%) next-day delivery and same-day delivery (61%), as shown in Exhibit 8. These findings are particularly compelling and reflect the evolution of consumers’ shopping behaviors, as 62% of those surveyed in June 2020 had never paid for expedited delivery. Exhibit 9 highlights this 53% jump in consumers who paid for faster delivery over the last few years.

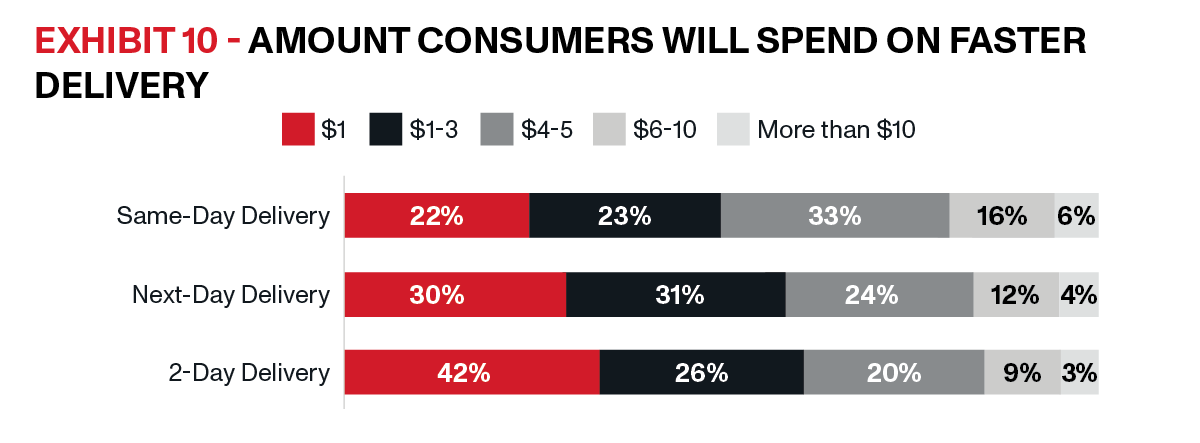

When it comes to how much consumers are willing to pay for faster delivery, most shoppers would spend at least $5 for same-day delivery and at least $3 for next-day and 2-day delivery, as shown in Exhibit 10.

Consumers have made clear that they have a need for speed. Whether a retailer offers faster delivery for free or at an additional cost, it is paramount that these options are provided in the first place. Retailers that fail to do so are at an increased risk of falling behind and losing out on the 63% of shoppers that chose to switch to another retailer due to slow delivery.

Consumers have made clear that they have a need for speed. Whether a retailer offers faster delivery for free or at an additional cost, it is paramount that these options are provided in the first place. Retailers that fail to do so are at an increased risk of falling behind and losing out on the 63% of shoppers that chose to switch to another retailer due to slow delivery.

The Demand for Home Delivery Is Growing

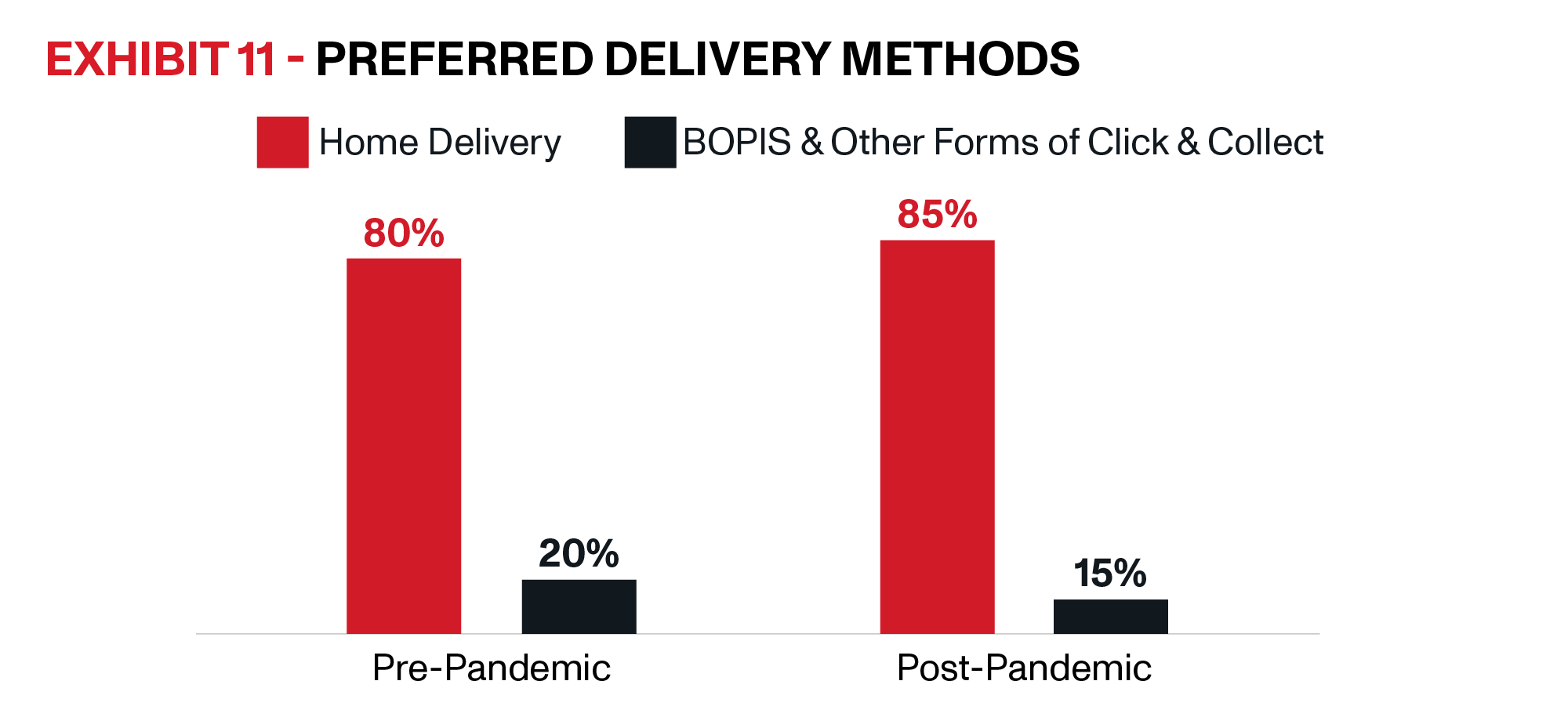

Though many retailers invested in buy online, pick up in-store (BOPIS) and other forms of click and collect during the pandemic, consumers still overwhelmingly want to have their items delivered to their home. Exhibit 11 shows that 85% of consumers prefer home delivery over BOPIS, up 6% compared to pre-pandemic.

As more consumers shop online, the demand for home delivery will only continue to grow. Exhibit 12 shows that 95% of consumers plan to maintain or increase their use of home delivery, with 81% planning to make this the primary way they receive items. This shift is happening sooner rather than later for most, with 41% expecting to transition to home delivery within the next year. As such, retailers that prioritize investing in faster home delivery stand to set themselves apart from competitors and attract customers.

As more consumers shop online, the demand for home delivery will only continue to grow. Exhibit 12 shows that 95% of consumers plan to maintain or increase their use of home delivery, with 81% planning to make this the primary way they receive items. This shift is happening sooner rather than later for most, with 41% expecting to transition to home delivery within the next year. As such, retailers that prioritize investing in faster home delivery stand to set themselves apart from competitors and attract customers.

Free Shipping Remains Critical Amid Inflation

A long-time purchase driver, free shipping continues to reign as the top reason why consumers will continue to shop online. Three-quarters of consumers view free shipping as the most important consideration when online shopping.

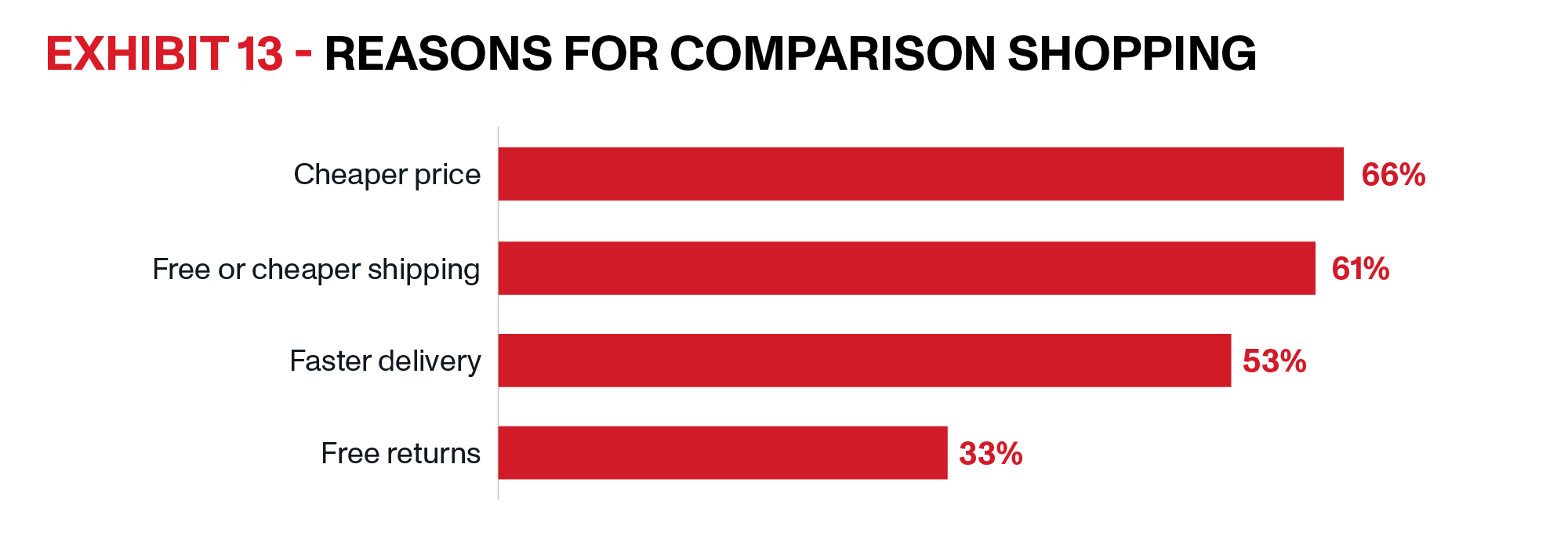

Free shipping has become especially critical to shoppers in today’s inflationary environment. Fifty-nine percent of consumers reported that they would stop shopping with a retailer that does not offer free shipping. As a result, consumers are shopping around for prices and free shipping, as shown in Exhibit 13.

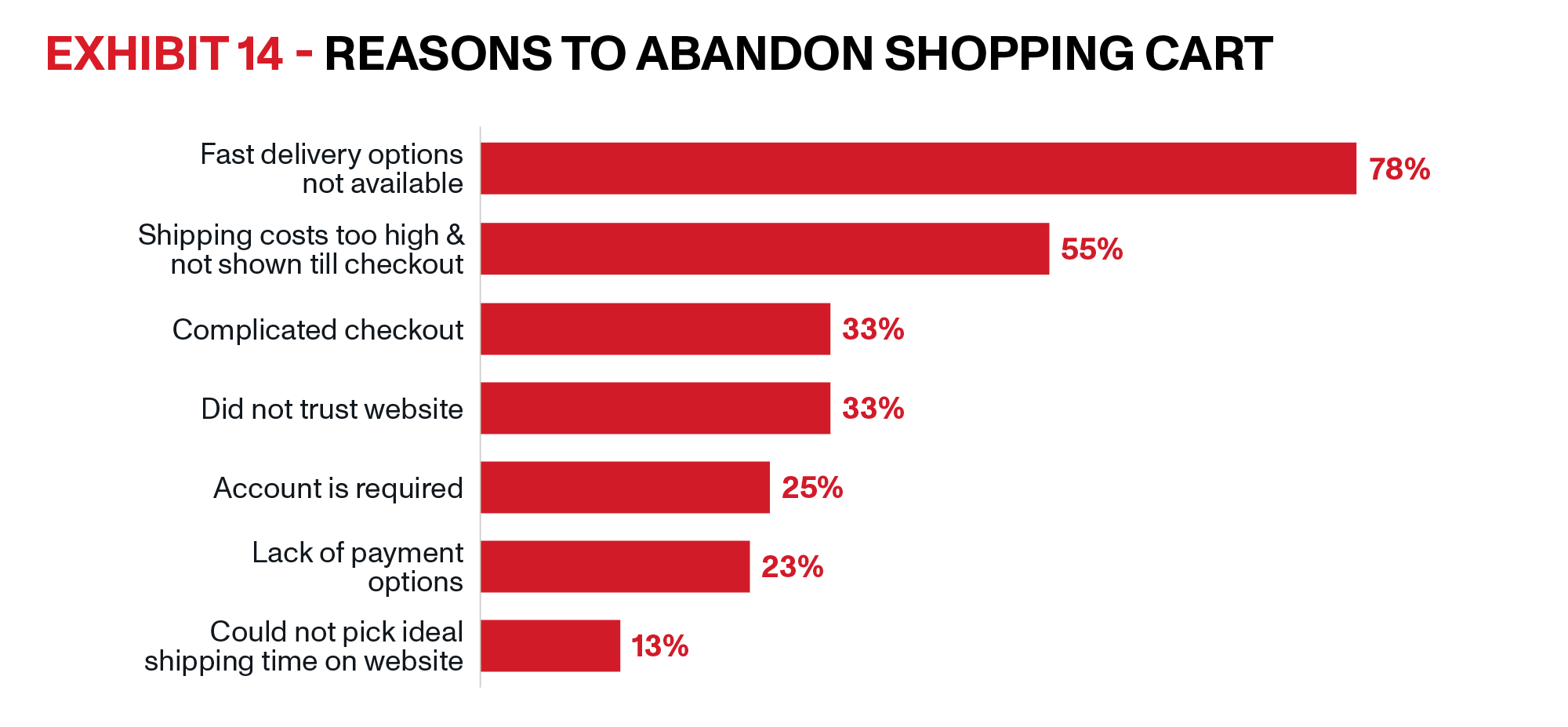

While consumers have explicitly expressed that they want to keep shopping online because of free shipping, shoppers expressed that slow delivery (78%) and expensive shipping costs (55%) are leading them to abandon their carts, as shown in Exhibit 14. Exhibit 15 shows additional ways that high shipping fees impacts consumers’ shopping decisions, driving 63% to choose a different retailer, 57% to stop shopping with that retailer, and 56% to shop in-store, despite their strong preferences for home delivery.

While consumers have explicitly expressed that they want to keep shopping online because of free shipping, shoppers expressed that slow delivery (78%) and expensive shipping costs (55%) are leading them to abandon their carts, as shown in Exhibit 14. Exhibit 15 shows additional ways that high shipping fees impacts consumers’ shopping decisions, driving 63% to choose a different retailer, 57% to stop shopping with that retailer, and 56% to shop in-store, despite their strong preferences for home delivery.

Consumer behaviors and purchasing habits have clearly changed. Online shoppers are demanding to have their items delivered to their homes fast and are buying from retailers who fulfill this need. Given that e-commerce is still growing, how can retailers respond and best position themselves to gain a competitive advantage?

Consumer behaviors and purchasing habits have clearly changed. Online shoppers are demanding to have their items delivered to their homes fast and are buying from retailers who fulfill this need. Given that e-commerce is still growing, how can retailers respond and best position themselves to gain a competitive advantage?

Recommendations

- Win Customers and Boost Brand Loyalty with Faster Delivery and Free Shipping

- Consumers Are Prioritizing Home Delivery—Retailers Should Too

- Diversify Your Carrier Mix with a Proven Alternative

Win Customers and Boost Brand Loyalty with Faster Delivery and Free Shipping

COVID-19 ushered in an unprecedented level of brand loyalty disruption. According to McKinsey, a whopping 75% of consumers engaged in new shopping behaviors, with nearly 40% fully deserting brands they previously trusted for new ones.1 Of the consumers we surveyed that still shop with some of the brands they used prior to the pandemic, many are willing to switch to other retailers for lower prices (39%) and faster delivery (32%).

Retailers seeking to re-establish brand loyalty and build customer lifetime value can start by addressing their customers’ top pain points: slow delivery and high shipping costs.

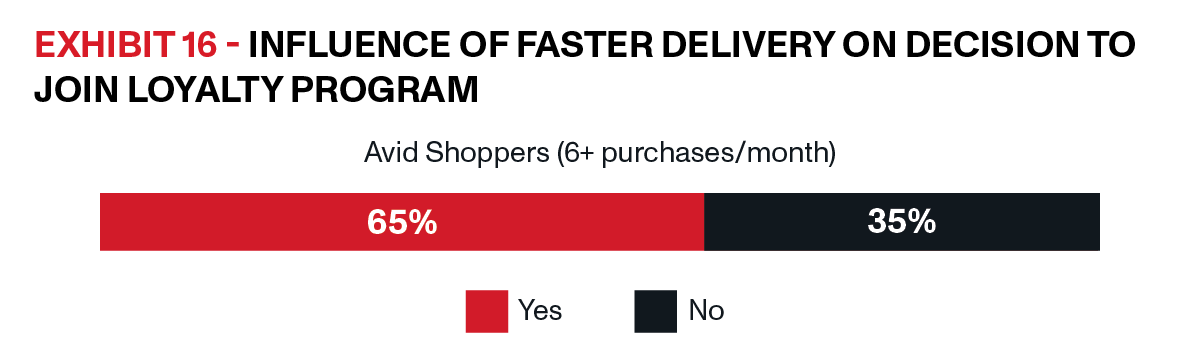

As online sales have increased, so have consumers’ demands for how quickly they want to receive their items, with 63% expecting to have their items delivered in two days or less. Faster delivery has become a leading purchase driver and empowers retailers to differentiate themselves and win customers and boost brand loyalty. Exhibit 16 shows that 65% of avid shoppers, who make six or more online purchases per month, would be willing to sign up for a loyalty program to get faster deliveries. Additionally, 73% of consumers would shop at a new retailer that provides next-day delivery.

In addition to delivery speed, free shipping remains crucial to acquiring and retaining customers. Eighty percent of consumers would shop at a new retailer due to free shipping, as shown in Exhibit 17, while another 60% would purchase again from a retailer that provides this feature.

In addition to delivery speed, free shipping remains crucial to acquiring and retaining customers. Eighty percent of consumers would shop at a new retailer due to free shipping, as shown in Exhibit 17, while another 60% would purchase again from a retailer that provides this feature.

Through the evolution and growth of e-commerce, consumers have come to view free shipping as the standard. According to a consumer trends report by Jungle Scout, 66% of shoppers expect free shipping on all orders,2 and they are increasingly unwilling to shop with a retailer that fails to meet this demand.

Through the evolution and growth of e-commerce, consumers have come to view free shipping as the standard. According to a consumer trends report by Jungle Scout, 66% of shoppers expect free shipping on all orders,2 and they are increasingly unwilling to shop with a retailer that fails to meet this demand.

When retailers accelerate how quickly they get items to their customers and offer free shipping, they not only increase profits, but also take a larger share of wallet. As more consumers shop online, retailers that can leverage fast and free delivery will enhance the customer experience and keep consumers coming back.

Consumers Are Prioritizing Home Delivery—Retailers Should Too

In today’s digital world where convenience is key, it is no surprise that consumers are looking for fast and reliable home delivery. With such seemingly straightforward preferences for speed and convenience, where are retailers missing the mark?

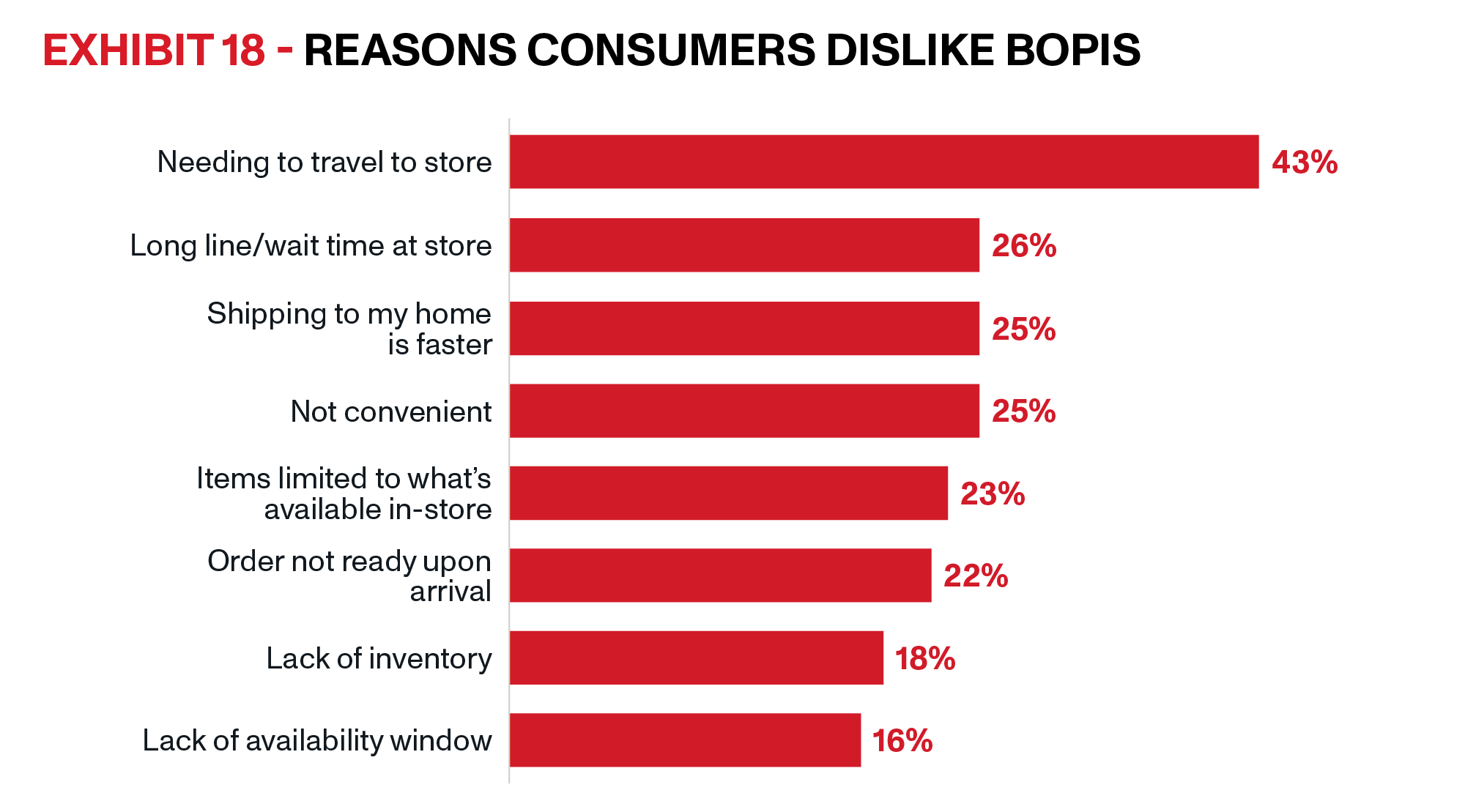

Many retailers implemented BOPIS (buy online, pick up in-store) at the start of the pandemic to offset rising shipping costs and capacity constraints. While consumers began using BOPIS, their reasons had nothing to do with preference or convenience. Rather, consumers’ adoption of BOPIS is a direct result of retailers not offering fast delivery options and free shipping. Sixty-four percent of consumers that use BOPIS are driven to do so to avoid paying for shipping, while 77% chose to shop in-store due to slow delivery. Exhibit 18 shows issues consumers have with BOPIS, with 43% citing the need to travel to the store as the aspect they dislike most.

With 64% of consumers planning to transition to home delivery in the next couple of years, retailers have a key opportunity to win market share by making investments to meet their expectations. Though BOPIS will continue to exist as an option, retailers should shift their focus and act now to adapt their supply chain strategies accordingly to get items on their customers’ doorsteps in a fast and reliable manner.

With 64% of consumers planning to transition to home delivery in the next couple of years, retailers have a key opportunity to win market share by making investments to meet their expectations. Though BOPIS will continue to exist as an option, retailers should shift their focus and act now to adapt their supply chain strategies accordingly to get items on their customers’ doorsteps in a fast and reliable manner.

Diversify Your Carrier Mix with a Proven Alternative

By their own admission, national carriers are focusing on revenue quality over partnerships with their retail customers, and selectively choosing volume that can maximize yield through GRIs, surcharges, and repricing customer accounts.

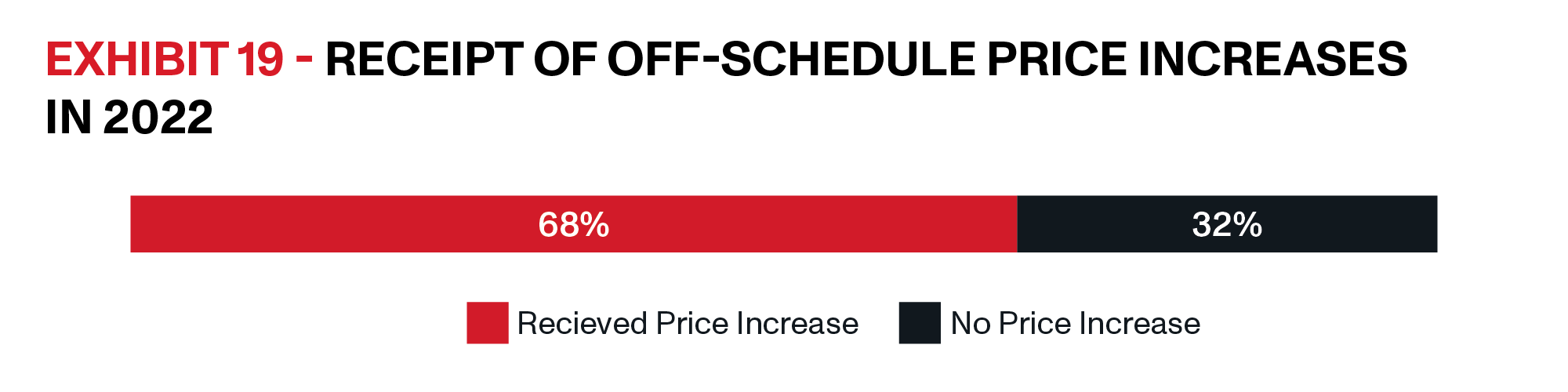

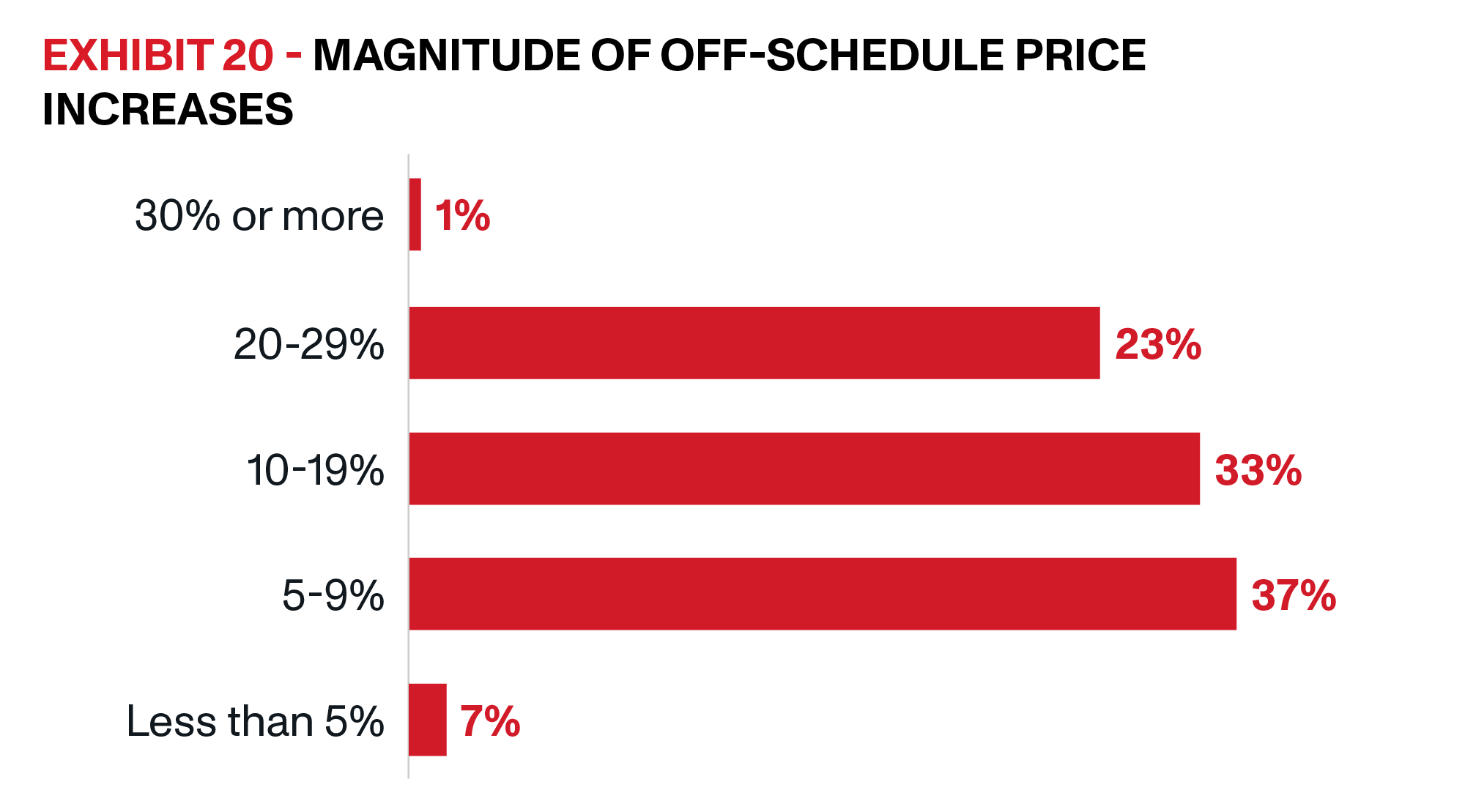

We surveyed over 150 supply chain leaders from leading omnichannel retailers and found that two-thirds (68%) experienced an off-schedule price increase in 2022 on top of general rate increases, with the majority of these price hikes falling between 5-9% (37%) or 10-19% (33%), as shown in Exhibits 19 and 20. Retailers using single-carrier strategies are also subject to an increased risk of supply chain disruptions and delays that compromise the delivery experience and prevent customers from coming back.

As retailers seek strategies to overcome these obstacles, it has become clear that putting all your eggs in the single-carrier basket no longer works. Retailers that diversify their carrier bases by moving away from the two national providers can differentiate themselves from the competition.

As retailers seek strategies to overcome these obstacles, it has become clear that putting all your eggs in the single-carrier basket no longer works. Retailers that diversify their carrier bases by moving away from the two national providers can differentiate themselves from the competition.

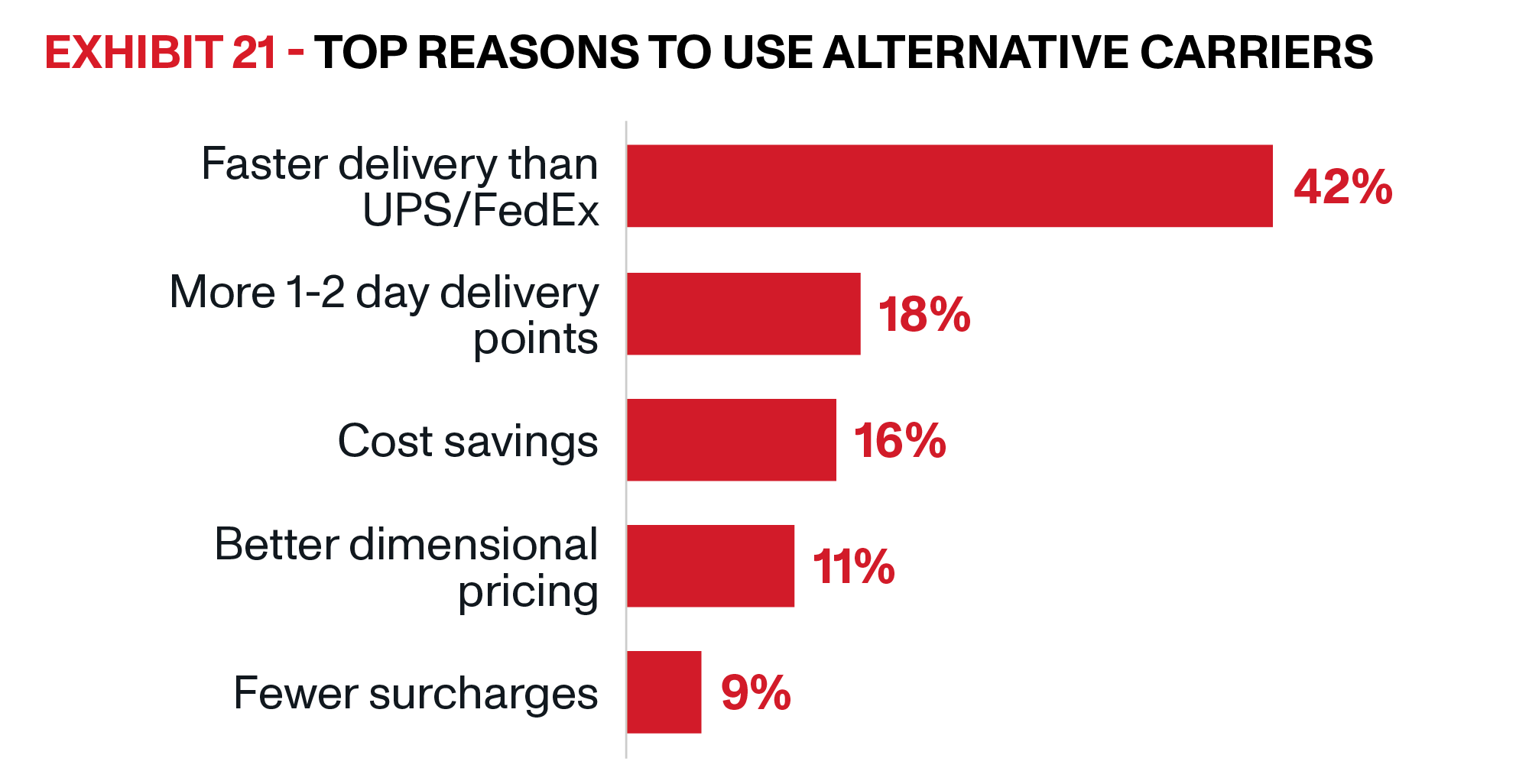

Alternative carriers help retailers win customers and build brand loyalty through faster delivery, improve flexibility and productive with later pickups, reduce spend, and increase capacity. Eighty-nine percent of top online retailers are currently leveraging alternative carriers. Sixty percent of retailers surveyed chose to use alternative carriers due to faster delivery, with another 36% indicating they were influenced by cost savings, as shown in Exhibit 21. Retailers also cited quality of delivery experience, on-time performance, and coverage as driving factors.

OnTrac is a proven alternative to the duopoly that can help retailers build supply chains that respond and adapt to consumer expectations through faster delivery, reliability, service, AND a nationwide reach. In summer 2022, OnTrac launched a transcontinental delivery service to empower retailers to reach 250 million of their customers across the country’s most populated metropolitan areas with faster, more reliable home delivery. OnTrac also launched in Texas in the fast-growing, urban megaregion of Austin, Dallas-Fort Worth, Houston, and San Antonio in July 2023 to reach an additional 19 million consumers. The Texas expansion increases OnTrac’s delivery network to reach 80% of the U.S. population across 31 states and Washington, D.C.

OnTrac is a proven alternative to the duopoly that can help retailers build supply chains that respond and adapt to consumer expectations through faster delivery, reliability, service, AND a nationwide reach. In summer 2022, OnTrac launched a transcontinental delivery service to empower retailers to reach 250 million of their customers across the country’s most populated metropolitan areas with faster, more reliable home delivery. OnTrac also launched in Texas in the fast-growing, urban megaregion of Austin, Dallas-Fort Worth, Houston, and San Antonio in July 2023 to reach an additional 19 million consumers. The Texas expansion increases OnTrac’s delivery network to reach 80% of the U.S. population across 31 states and Washington, D.C.

Consumers have made their demands for fast and free home delivery clear. However, a large gap still exists between what consumers are expecting from their shopping experience and what retailers are providing. Retailers cannot ignore the tremendous opportunity to offer faster home delivery to acquire new customers, build brand loyalty, and improve the customer experience. Retailers that act now to diversify their carrier mixes with a faster, cost-effective alternative that can help them meet consumers’ expectations, differentiate from the competition, and position themselves for long-term success.

About the Author

An industry veteran with over 20 years of experience, Josh Dinneen is the Chief Commercial Officer at OnTrac, the carrier of choice for last-mile, e-commerce parcel delivery, where he oversees revenue strategy, sales, marketing, account management, and call center operations. Josh has spearheaded the company’s transcontinental delivery service launch, which connects two complementary operating footprints to provide faster, cost-effective, coast-to-coast delivery to leading shippers and retailers.

About Hanover Research

Founded in 2003, Hanover Research is a global market research and analytics firm that delivers market intelligence through a unique, fixed-fee model to more than 1,000 clients. Headquartered in Arlington, Virginia, Hanover employs high-caliber market researchers, analysts, and account executives to provide a service that is revolutionary in its combination of flexibility and affordability. Hanover was named a Top 50 Market Research Firm by the American Marketing Association in 2015, 2016, 2017, and 2018, and has also been twice named a Washington Business Journal Fastest Growing Company. To learn more about Hanover Research, visit https://www.hanoverresearch.com.

Definitions

Generation Z / Young millennial: 18-35 years old

Millennial: 26-34

Generation X: 35-54

Baby Boomers and older: 55+

Methodology

The findings in this report are based on a survey commissioned by OnTrac and conducted by Hanover Research of over 150 C-Suite, VP, and director level supply chain professionals with decision-making power at large retailers about the challenges they are currently facing. Percentages may not add up to 100% due to rounding. Some respondents chose not to answer certain demographic questions.