The growth opportunities for retailers in the e-commerce industry today are greater than ever—but so are the challenges. Over the last three years, retailers working to capitalize on e-commerce penetration and heightened demand have had to balance meeting consumer demands for faster home delivery with price hikes, surcharges, and capacity constraints that erode profitability and put the customer experience at risk.

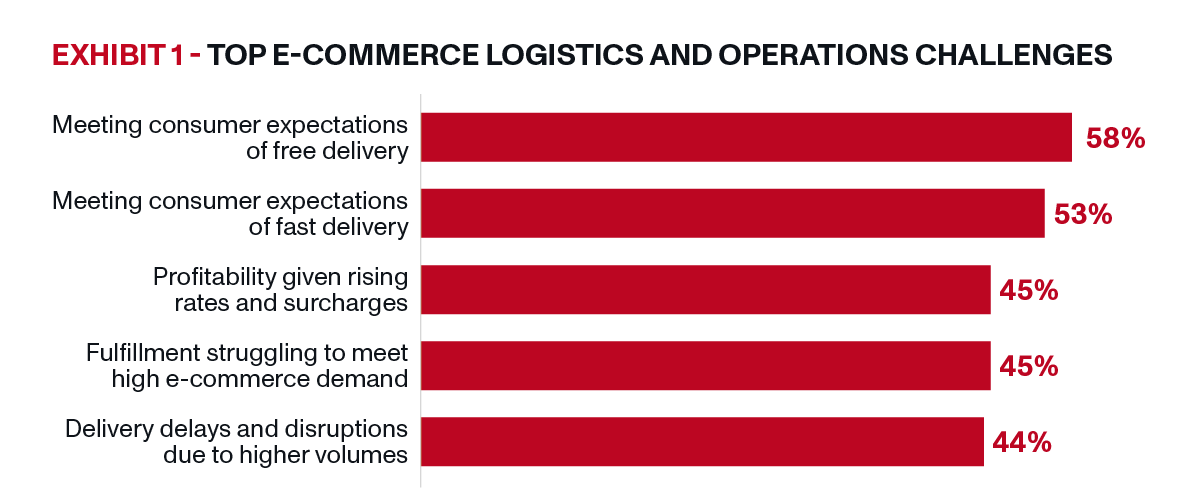

As we move into the post-pandemic era and levels of e-commerce continue to increase, with U.S. online retail sales poised to reach $1.7 trillion by 2027, retailers are still grappling with how to achieve growth. Exhibit 1 shows the greatest obstacles supply chain professionals at large retailers are currently facing, with more than half of those surveyed finding it challenging to meet consumer expectations of both free and fast delivery.

OnTrac partnered with Hanover Research to survey over 150 C-Suite, VP, and director level supply chain professionals at large retailers about the challenges they’re currently facing, how they plan to respond to those challenges, and areas in which they plan to invest. The results indicate that retailers plan to invest in faster delivery, retailers are increasingly relying on alternative carriers, surcharges and off-schedule rate increases are making shipping more expensive, and retailers have already implemented BOPIS and other forms of click and collect.

In this whitepaper, we will dive into the key takeaways and offer recommendations to help retailers overcome these obstacles and position your supply chain to deliver a competitive advantage.

Key Takeaways:

-

Speed Matters: 72% of Retailers Plan to Move to 2-Day Delivery

-

Retailers Are Relying on Alternative Carriers

-

Surcharges and Rate Increases Are Making Shipping More Expensive

-

Retailers Have Already Implemented BOPIS and Click and Collect

Speed Matters: 72% of Retailers Plan to Move to 2-Day Delivery

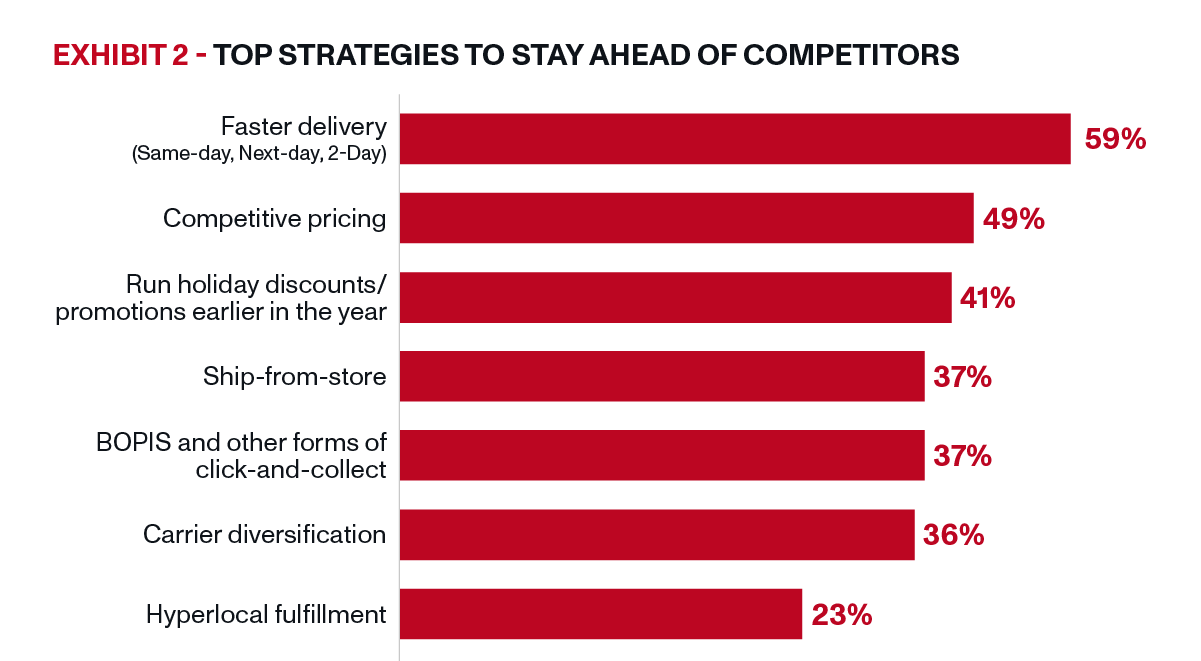

We asked over 5,000 consumers about their shopping habits and preferences, and 97% of those surveyed called faster delivery an important factor in their purchasing decisions. With such resounding attention on speed, it is no surprise that retailers are prioritizing how to get products to their customers as quickly as possible. According to Exhibit 2, retailers intend to leverage faster delivery as their primary differentiating strategy, despite having expressed that this is also one of their greatest challenges (see Exhibit 1 above).

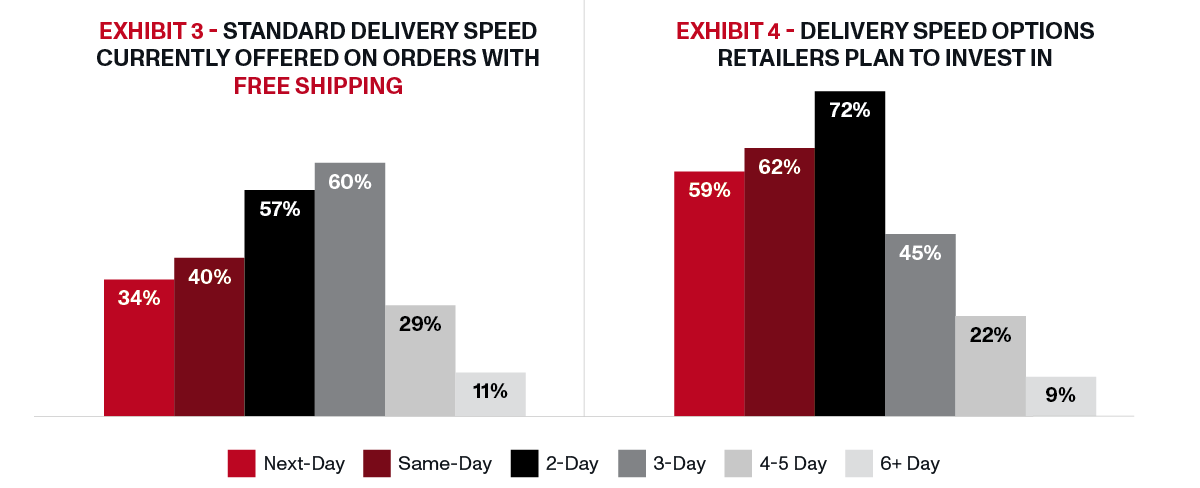

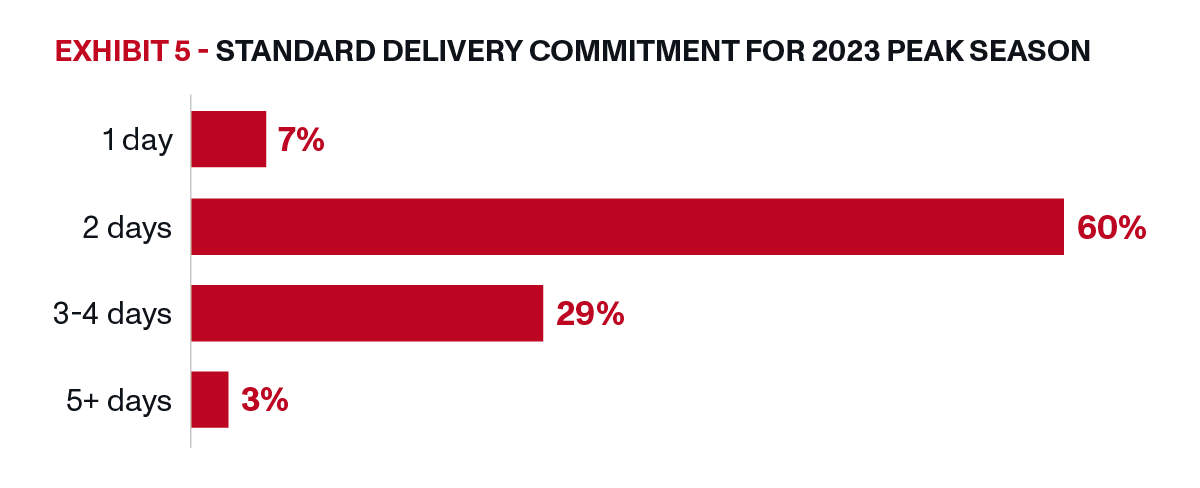

Only 57% of retailers are currently offering two-day delivery on orders with free shipping, as shown in Exhibit 3, but retailers are furthering their investments in speed to keep up with consumer expectations of fast delivery and not fall behind. Exhibit 4 shows that almost three-quarters (72%) of retailers plan to invest in two-day delivery over the next two years. In the short-term, Exhibit 5 shows that nearly two-thirds (60%) of retailers plan to offer two-day shipping as their standard delivery commitment during the 2023 peak season, up 11% from 2022.

Consumers have made clear that speed matters, and retailers are adapting their supply chains accordingly. Retailers that invest in faster delivery are well-positioned to acquire and retain customers, while transforming their shipping strategy into a competitive differentiator.

Retailers Are Relying on Alternative Carriers

When COVID-19 sparked the rapid shift from in-store to online shopping, retailers had to revamp their supply chains overnight. The pandemic quickly exposed the problems with single-carrier shipping strategies, leading retailers to turn to alternative carriers to accommodate heightened volume and offset the seemingly endless surcharges and rate increases implemented by FedEx and UPS.

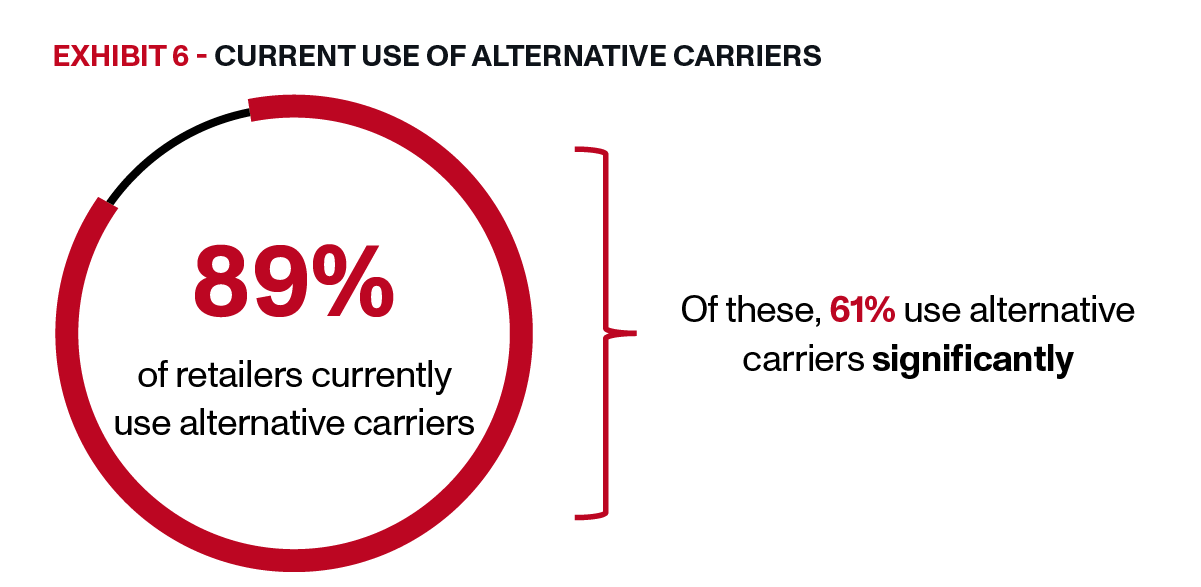

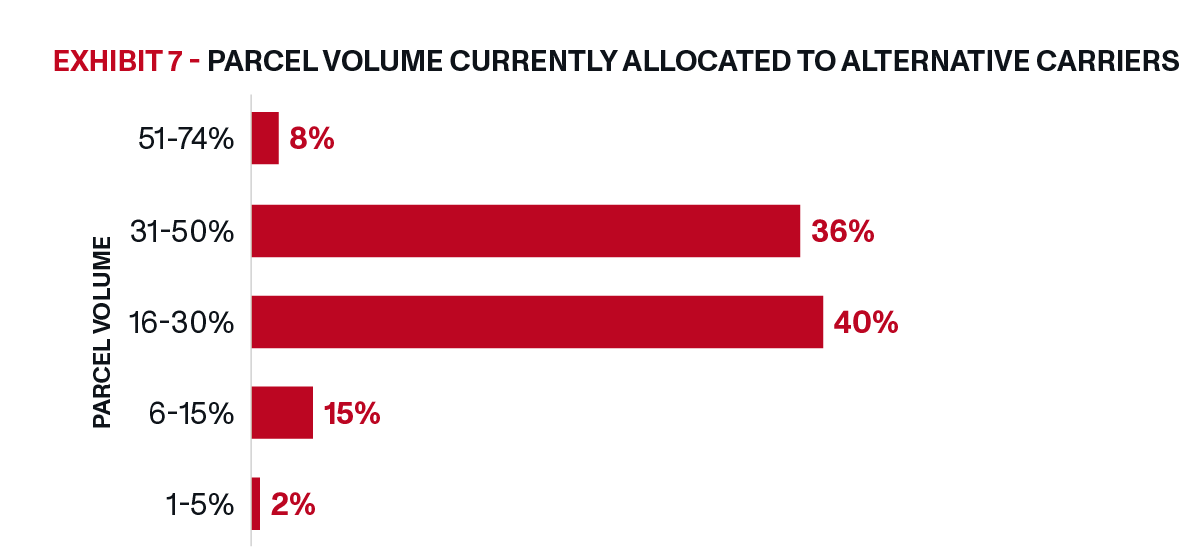

Though initially fueled by the pandemic, the race for carrier diversity is not slowing down today, and retailers are realizing the benefits. Compared to national carriers, alternative carriers provide faster delivery times, are more flexible, and offer better shipping rates. As such, alternative carriers have become a fundamental part of the e-commerce infrastructure, with 89% of retailers surveyed currently using alternative carriers, as shown in Exhibit 6. Exhibit 7 shows that of those, three-quarters (76%) are allocating between 16-50% of their total volume to alternative carriers. This trend is expected to keep pace, with more than half (53%) indicating they will use alternative carriers in the next 12 months. These findings are particularly compelling and reflective of the staying power of alternative carriers, which were responsible for only 4% of parcel deliveries in January 2020.

Surcharges and Rate Increases Are Making Shipping More Expensive

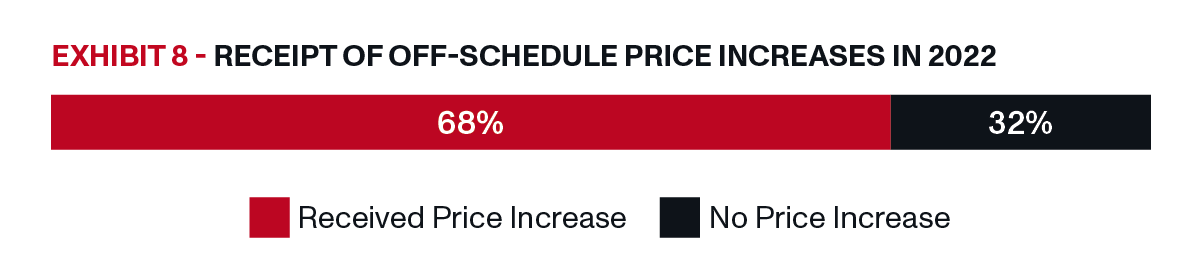

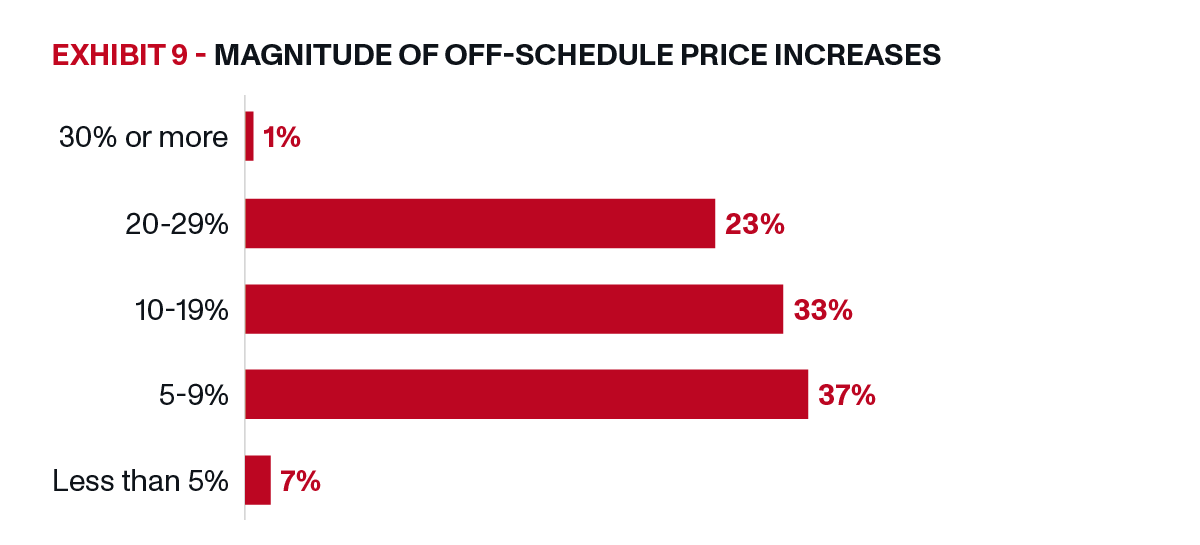

Since the start of the e-commerce shift, the duopoly has admittedly focused on revenue quality rather than their retail partners. While this strategy has helped national carriers generate billions of dollars in profits while their volumes have declined, retailers have been getting squeezed by the resulting price hikes that hurt their margins. Exhibit 8 shows that two-thirds (68%) of top online retailers experienced an off-schedule price increase in 2022 on top of general rate increases. The majority of these price hikes fall between 5-9% (37%) or 10-19% (33%), as shown in Exhibit 9.

Many retailers have already implemented strategies to compensate for higher shipping costs. Exhibit 10 shows that 87% have opted for slower shipping, despite consumers’ clear demands for faster delivery, putting those retailers at an increased competitive disadvantage and risk of losing customers.

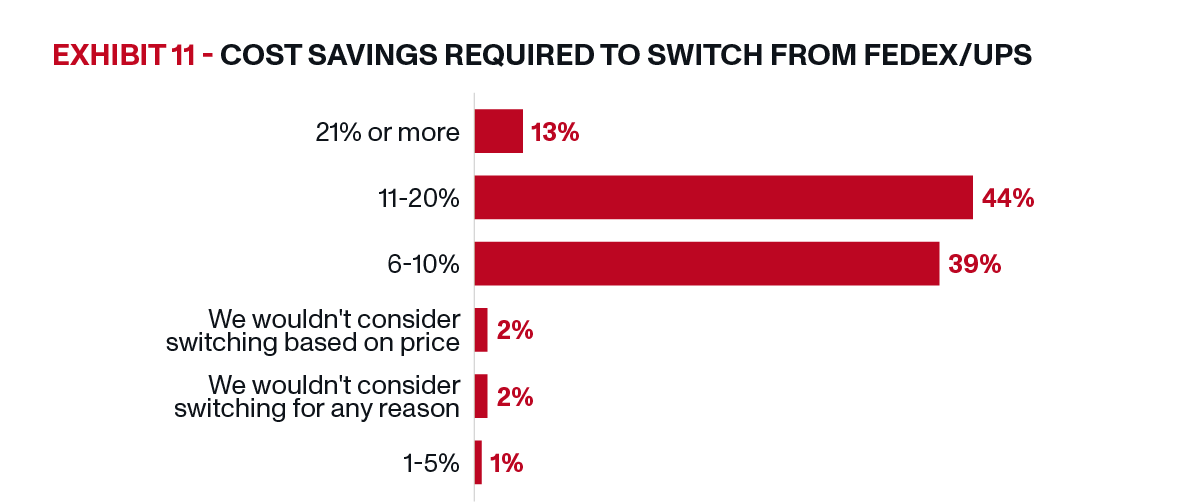

When it comes to choosing to send their business elsewhere, cost savings are a top driving factor. Exhibit 11 shows that 83% of retailers would switch from FedEx/UPS to get up to 20% cost savings.

Raising prices in an inflationary, increasingly competitive environment, with no signs of letting up, necessitates that shippers look to alternative carriers to offset cost increases, protect their margins, and build flexibility within their supply chains. Those who forgo diversifying their carrier mixes and continue to rely on single-carrier strategies will increasingly feel the pressure from rising costs and risk falling behind their competitors.

Retailers Have Already Implemented BOPIS and Click and Collect

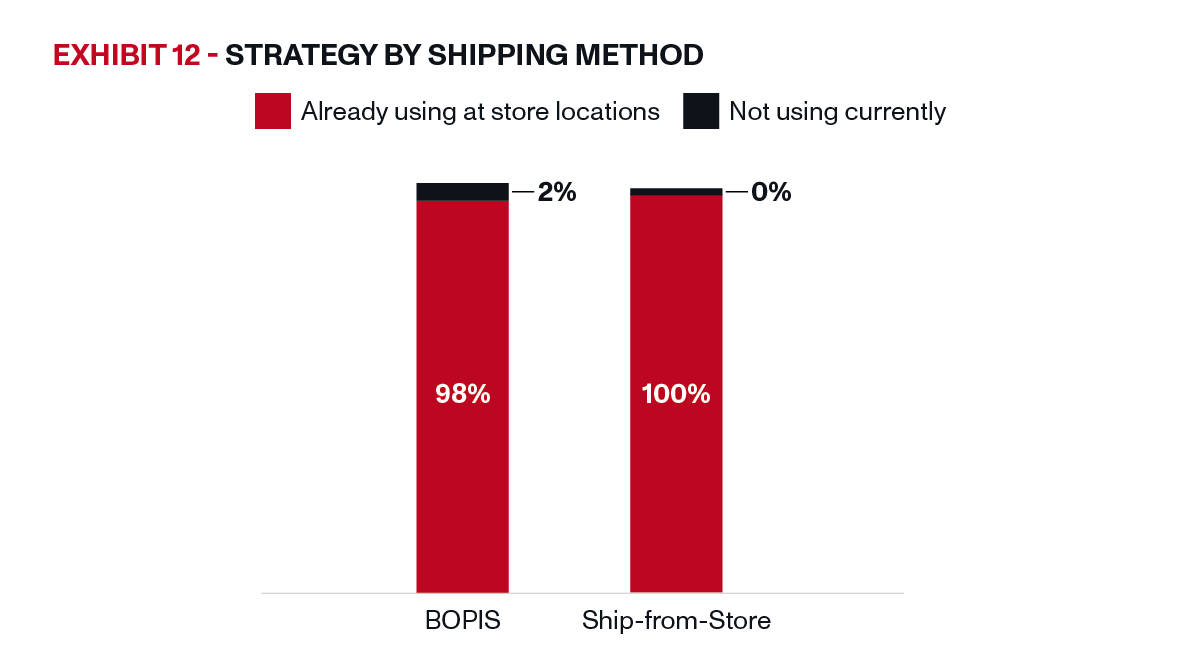

The adoption of buy online, pick up in-store (BOPIS) and other forms of click and collect, including curbside pickup, grew significantly as retailers worked to offset rising logistics and last-mile delivery costs. Exhibit 12 shows that today all retailers surveyed are using ship-from-store and 98% are offering BOPIS from at least some store locations, with 83% planning to expand these options to additional stores.

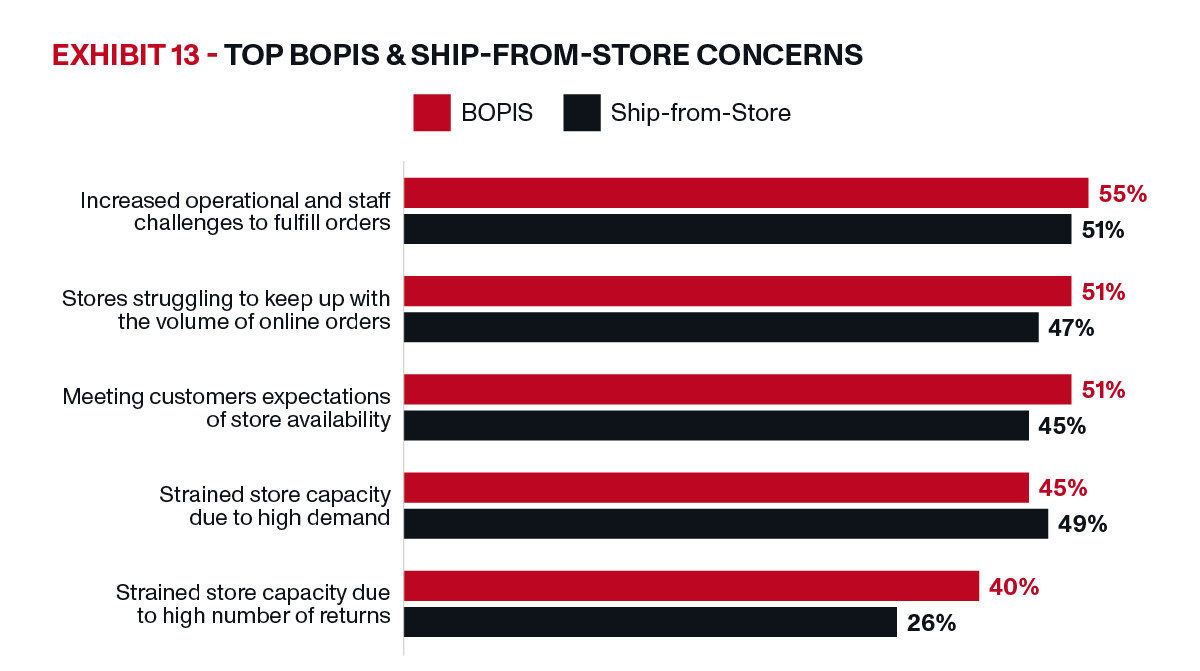

While there is no denying the growth of BOPIS, significant operational and logistics challenges remain that largely stem from the physical stores themselves. Exhibit 13 shows that more than half of retailers are concerned about the impacts of ship-from-store on store operations and staff. Consumers anticipate their BOPIS orders to be ready for pickup within a few hours after checkout. This expectation for a quick turnaround adds pressure to staff who may lack training in order fulfillment. Additionally, brick-and-mortar stores were not designed for fulfillment and pickup of online orders, and when inventory is not quickly available, retailers risk losing sales to competitors that can fulfill a consumers’ order more quickly.

In order to implement BOPIS successfully, retailers will need to invest in inventory management systems to get real-time stocking updates and merge online and in-store inventory tracking. Retailers must also communicate clearly with customers across multiple channels on how to best use click and collect in stores to ensure a seamless, efficient pickup experience, while minimizing wait times.

How Can Retailers Adapt Their Supply Chains to Successfully Lead in a Post-COVID Environment?

Recommendations:

-

Leverage Faster Delivery to Win Customers and Build Brand Loyalty

-

Prioritize Fast and Free Home Delivery

-

Diversify Your Carrier Mix with a Proven Alternative

Leverage Faster Delivery to Win Customers and Build Brand Loyalty

In order to compete in today’s increasingly brand-agnostic environment, retailers can’t afford to ignore consumers’ growing demands for speed. Faster delivery has evolved into a key purchase driver that retailers can use to stand out from competitors, acquire customers, and re-establish brand loyalty.

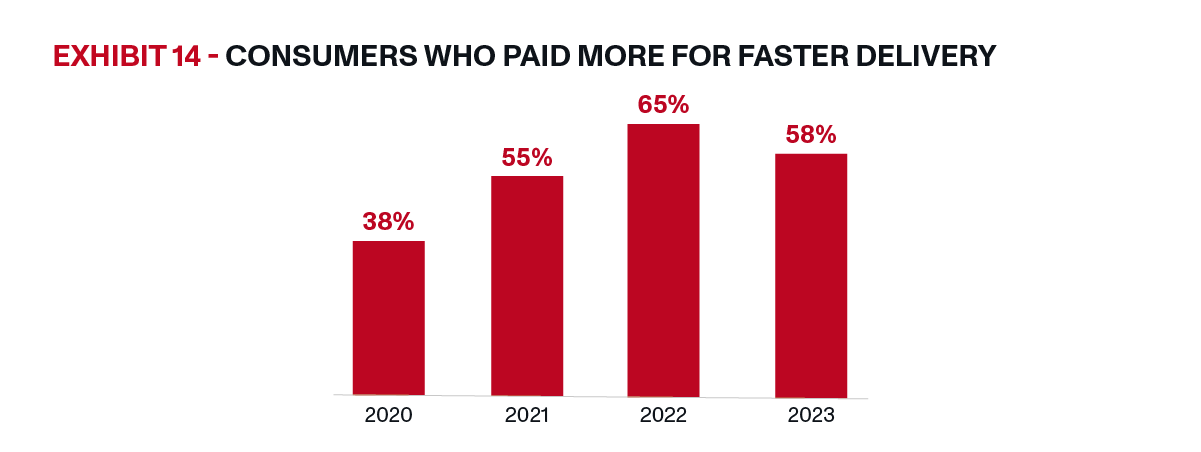

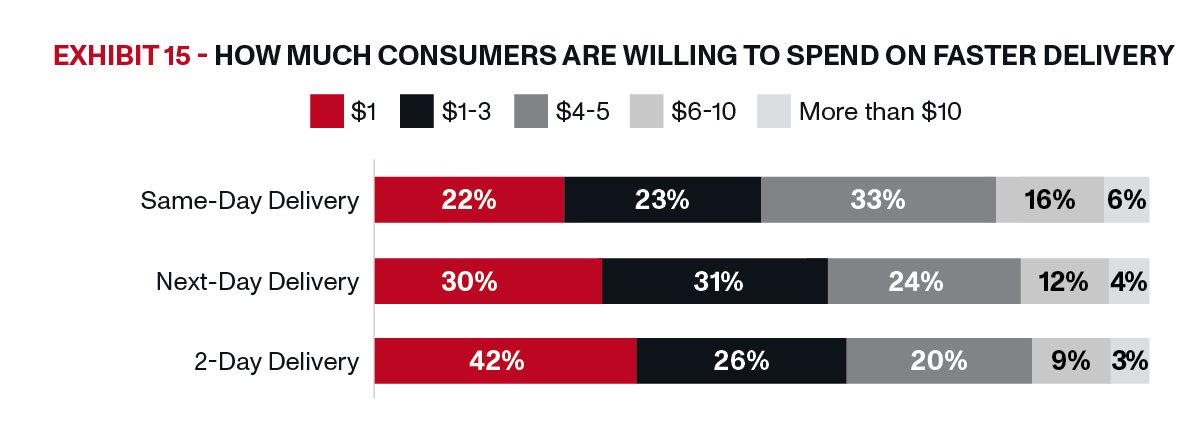

Not only does faster delivery differentiate, but consumers are paying more for it, as shown by Exhibit 14. Of those, two-thirds (69%) of consumers paid more for next-day delivery and same-day delivery (61%). When it comes to how much consumers are willing to spend, the majority expressed that they would pay $5 or more for same-day delivery and at least $3 for next-day and 2-day delivery (Exhibit 15).

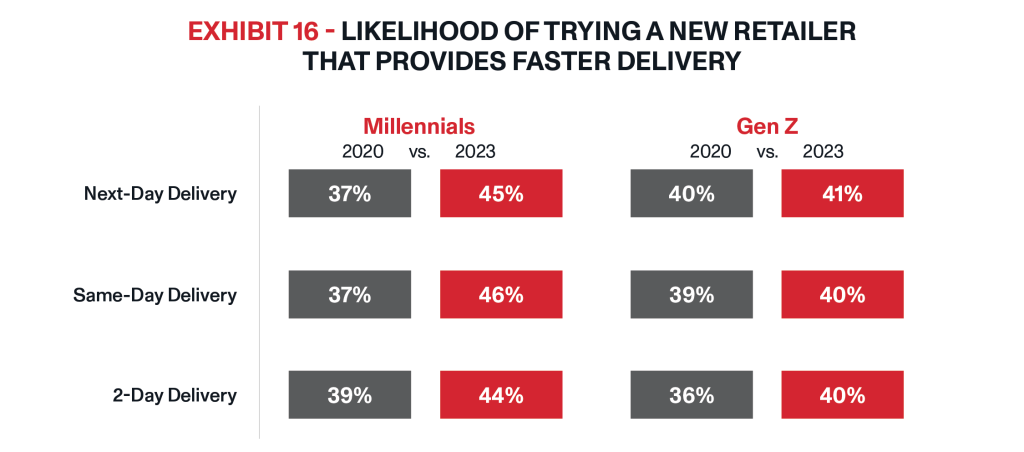

Faster delivery also plays a key role in driving customer loyalty. Over half (53%) of consumers surveyed would sign up for a loyalty program in order to get faster delivery. Speed also plays a critical influence in attracting younger consumers, who value convenience and seamless online shopping experiences. Exhibit 16 reflects the growing influence of faster delivery, particularly next-day and same-day delivery, on Millennials and Gen Z shoppers compared to pre-pandemic levels.

When retailers accelerate how quickly they get items to their customers, they will not only increase profits, but will also take a larger share of the market. As more consumers shop online and Gen Z and Millennials gain more purchasing power, speed will continue to grow in importance and retailers that can leverage faster delivery as a retention tool will increase customer lifetime value.

Prioritize Fast and Free Home Delivery

While consumers’ usage of BOPIS and other forms of click and collect has grown considerably since the start of the pandemic, it is not because of convenience or preference. Forty-four percent of consumers were driven to use BOPIS because a retailer failed to offer faster delivery, while 20% used BOPIS to avoid paying shipping fees.

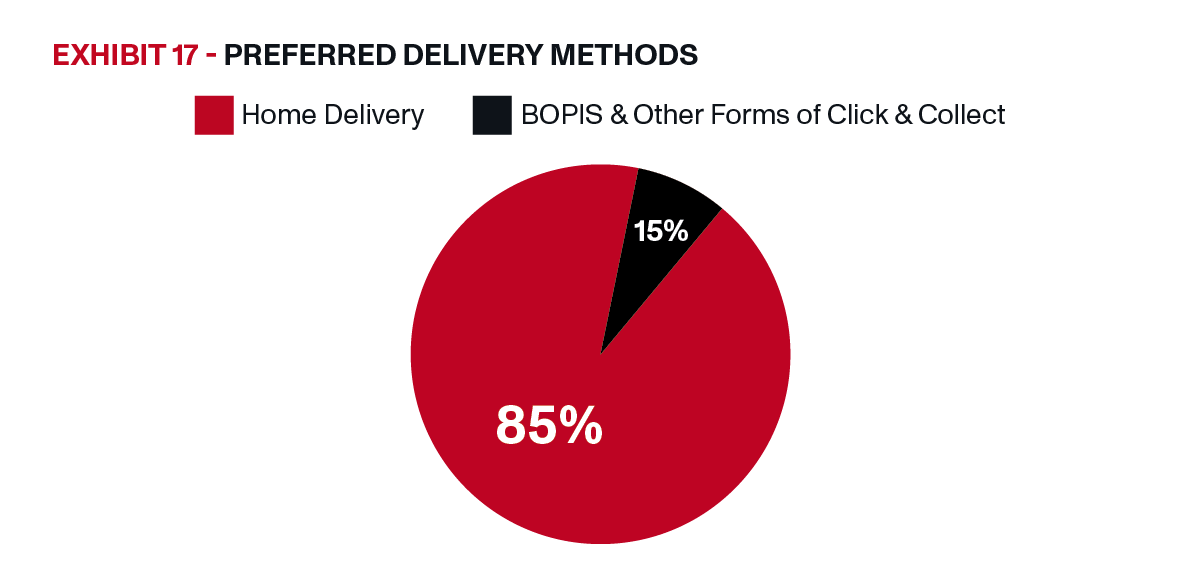

Despite nearly all retailers offering BOPIS, consumers would still rather have their orders delivered to their home. Exhibit 17 shows that 85% of consumers prefer home delivery over BOPIS, while 43% cite having to travel to the store as their main reason for disliking BOPIS.

While BOPIS will continue to exist as an option, consumers plan to increase their use of home delivery as they increase their online shopping levels (Exhibit 18). Retailers that can provide free shipping and deliver products directly to their customers’ doorsteps more quickly will be better positioned to build brand loyalty and gain a lasting edge over competitors, while also avoiding the operational problems and required investment that come with BOPIS.

Diversify Your Carrier Mix with a Proven Alternative

With all the control in the hands of national carriers, retailers are unable to build a supply chain with the flexibility, resiliency, and adaptability needed to meet evolving consumer preferences.

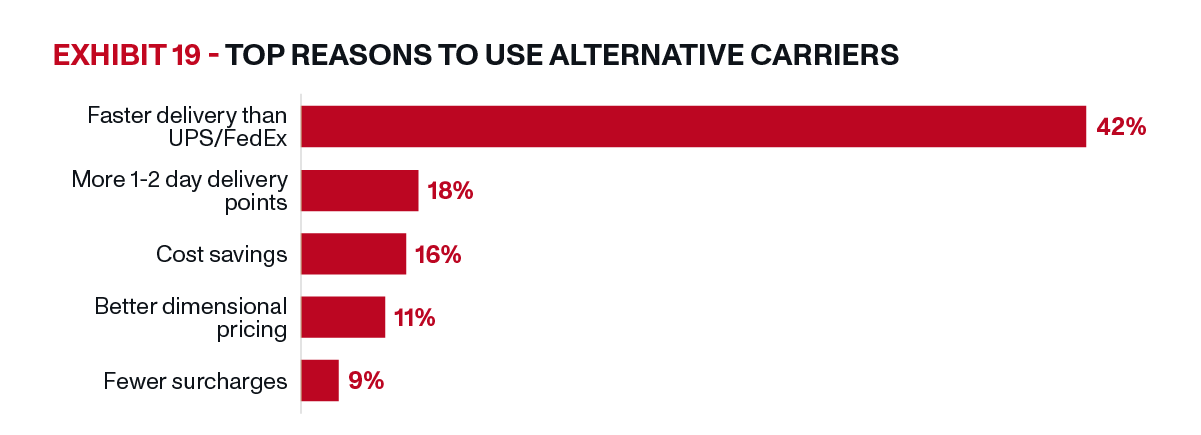

As e-commerce grows and brand loyalty declines, retailers that diversify their carrier bases by moving away from the two national providers can differentiate themselves from the competition. Alternative carriers help retailers by providing faster delivery that attracts and retains customers, greater flexibility, cost-savings, and more support than national carriers. Sixty percent of retailers chose to use alternative carriers due to faster delivery, with another 36% indicating they were influenced by cost savings, as shown in Exhibit 19. Retailers also cited quality of delivery experience, on-time performance, and coverage as driving factors.

While these benefits are significant, 44% of retailers still have concerns around using alternative carriers, citing limited delivery area as the main drawback. But what if retailers had a carrier that could offer speed, reliability, service, AND a nationwide reach? OnTrac is a proven alternative to the duopoly that can help retailers build supply chains that respond and adapt to consumer expectations. The OnTrac last mile delivery e-commerce parcel network empowers retailers with the largest 1 and 2 day ground delivery footprint to meet their customers’ expectations of faster delivery. In summer 2022, OnTrac launched its transcontinental delivery service to enable retailers to their customers across the country’s most populated metropolitan areas from coast-to-coast in as little as 3 days. OnTrac is also launching in Texas in the fast-growing, urban megaregion of Austin, Dallas-Fort Worth, Houston, and San Antonio in July 2023 to reach an additional 19 million consumers. The Texas expansion will grow OnTrac’s delivery network to reach 80% of the U.S. population across 31 states and Washington, D.C.

Given the volatile environment at FedEx and UPS, there is no better time than now to seek alternative carriers solutions to mitigate your risk of service disruptions. Both companies have struggled recently with a number of labor issues, with a potential strike looming at UPS, which would lead to significant volume delays and disruptions. Additionally, FedEx slashed its Sunday delivery services from 80% down to 50% of the U.S. population in March. These issues come after FedEx and UPS unveiled a 6.9% GRI increase for 2023—the largest in the history of both companies—after already levying a myriad of surcharges and off-schedule rate increases over the past three years.

Retailers that do not leverage alternative carriers are at a competitive disadvantage. When looking to add alternative carriers, it is important to be proactive and secure a partner well in advance of peak season. Waiting until Q4 is too late, as most alternative carriers have already planned for a certain amount of volume to deliver across their networks and will not be able to take on additional customers.

___

Shopping behaviors introduced by the pandemic are here to stay, and retailers that fail to adapt will lose business and fall behind. As the shift to e-commerce accelerates, retailers have a unique opportunity to differentiate from competitors and build brand loyalty by providing faster home delivery and diversifying their carrier bases. Retailers need to act now to seek proven alternative carriers to build flexible, resilient supply chains that respond to evolving consumer demands and set them up for lasting success.

About the Author

An industry veteran with over 20 years of experience, Josh Dinneen is the Chief Commercial Officer at OnTrac, the carrier of choice for last-mile, e-commerce parcel delivery, where he oversees revenue strategy, sales, marketing, account management, and call center operations. Josh has spearheaded the company’s transcontinental delivery service launch, which connects two complementary operating footprints to provide faster, cost-effective, coast-to-coast delivery to leading shippers and retailers.

About Hanover Research

Founded in 2003, Hanover Research is a global market research and analytics firm that delivers market intelligence through a unique, fixed-fee model to more than 1,000 clients. Headquartered in Arlington, Virginia, Hanover employs high-caliber market researchers, analysts, and account executives to provide a service that is revolutionary in its combination of flexibility and affordability. Hanover was named a Top 50 Market Research Firm by the American Marketing Association in 2015, 2016, 2017, and 2018, and has also been twice named a Washington Business Journal Fastest Growing Company. To learn more about Hanover Research, visit https://www.hanoverresearch.com.

Definitions

Generation Z / Young millennial: 18-35 years old

Millennial: 26-34

Generation X: 35-54

Baby Boomers and older: 55+

Methodology

The findings in this report are based on a survey commissioned by OnTrac and conducted by Hanover Research of over 150 C-Suite, VP, and director level supply chain professionals with decision-making power at large retailers about the challenges they are currently facing. Percentages may not add up to 100% due to rounding. Some respondents chose not to answer certain demographic questions.

References:

-

eMarketer, “U.S. Retail E-Commerce Sales, 2022-2027,” February 2023

-

Supply Chain Dive, “Mapping and charting the growth of regional parcel carriers,” November 2020

-

Reuters, “FedEx to further trim Sunday deliveries,” January 2023

-

Multichannel Merchant, “UPS Matches FedEx With 6.9% GRI for 2023,” October 2022