How Retailers Are Adapting to Overcapacity & Complex Carrier Discounts in a Buyer’s Market

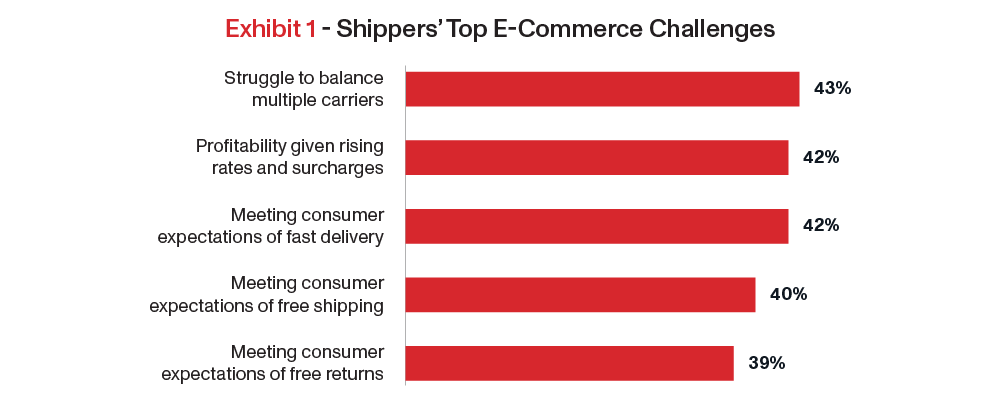

The e-commerce landscape is in a constant state of evolution. Over the last few years, consumers have come to depend on online shopping for their daily needs, mounting the pressure on retailers to provide a faster, hassle-free home delivery experience that meets their expectations. At the same time, retailers are constantly facing a number of supply chain challenges, ranging from avoiding the skyrocketing price hikes and capacity limits from national carriers in 2020, to overcoming the impacts of inflation and softened demand today. Exhibit 1 shows the greatest obstacles supply chain professionals are currently managing.

As the industry continues to evolve, one thing remains true: A retailer’s supply chain strategy is fundamental to their success and can make or break their business. How retailers handle their supply chain strategies today is not the same as it was three years ago, and adapting to the ever-changing environment is critical.

OnTrac partnered with Hanover Research to survey 300 C-Suite, VP, and director level supply chain professionals at large retailers about the challenges they’re currently facing, how they plan to respond to those challenges, and areas in which they plan to invest. The results indicate that retailers are investing in faster delivery, leveraging multi-carrier strategies, consolidating their carrier bases, and have already implemented buy online, pick up in-store (BOPIS) and other forms of click and collect.

In this whitepaper, we will dive into the key takeaways and offer recommendations to help retailers overcome these obstacles and develop a supply chain strategy that delivers a competitive advantage.

Key Takeaways

- Retailers are Investing in 2-Day Delivery or Faster

- Retailers have Embraced Carrier Diversification

- Carrier Consolidation is Already Happening

- Retailers Have Already Implemented BOPIS and Click and Collect

Retailers Are Investing in Two-Day Delivery or Faster

Consumers today are increasingly shopping around to find faster delivery options—and retailers are working to answer the call in order to win back customers.

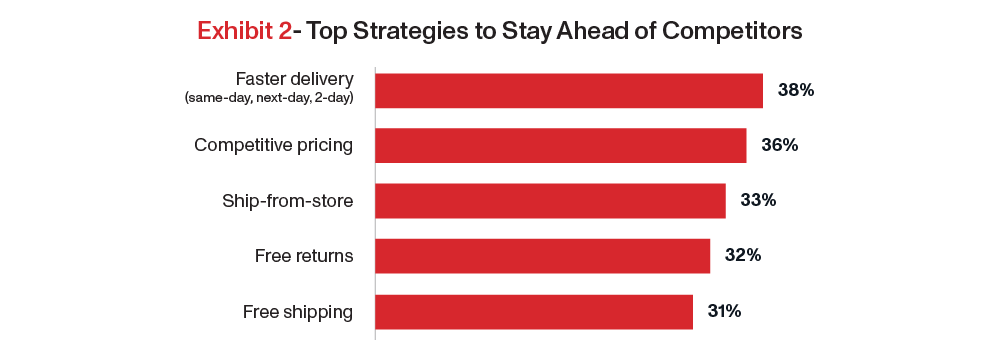

We asked over 6,000 consumers about their shopping habits and preferences and 100% said that faster delivery influenced their decision to shop with a retailer. With so much focus on speed, it is no surprise that retailers are prioritizing how to deliver orders to their customers as quickly as possible. Nearly 40% of retailers plan to leverage faster delivery as their primary differentiating strategy, as shown in Exhibit 2.

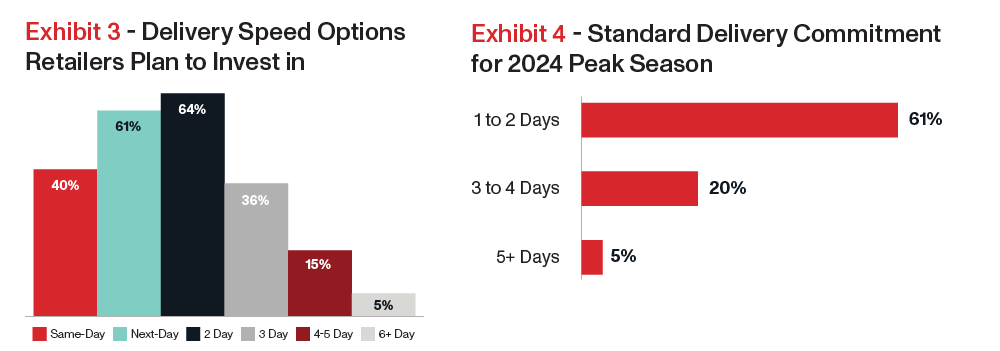

When it comes to the level of speed retailers are aiming to achieve, two-day delivery or faster is the goal. Exhibit 3 shows that 64% plan to invest in two-day delivery over the next two years, while 61% plan to offer two-day delivery or faster as their standard commitment for the 2024 peak season, as shown in Exhibit 4.

As faster delivery continues to drive more purchasing decisions, retailers are investing in speed to differentiate from the competition. Retailers that make faster delivery part of a seamless online shopping and delivery experience stand to acquire and retain customers and boost brand loyalty.

Retailers Have Embraced Carrier Diversification

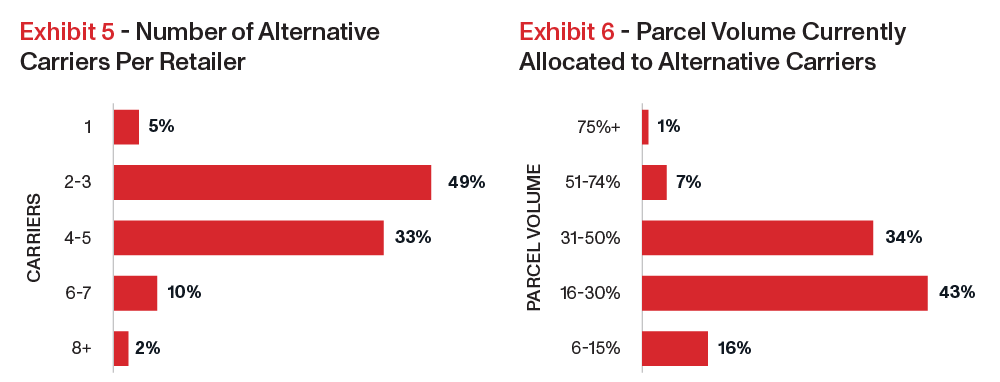

Carrier diversification is no longer a trend but has become fundamental to a successful supply chain strategy. Retailers have experienced the positive impacts of using alternative carriers and continue to lean on them today. Nearly all retailers currently use at least two alternative carriers, while 45% use four or more carriers. More than three-quarters (77%) are sending 16-50% of their total volume to alternative carriers, as shown in Exhibits 5 and 6.

Why are retailers diversifying their carrier bases? The pandemic proved the dangers of single-carrier strategies, revealing that relying solely on one parcel carrier subjects shippers to a multitude of risks, including rising costs, limited flexibility, and delivery delays and supply chain disruptions that compromise the customer experience. Compared to national carriers, alternative carriers provide faster delivery times, lower costs, increased flexibility, and personalized support.

The use of multi-carrier strategies is expected to continue moving forward, with 76% of retailers planning to utilize alternative carriers over the next year. This data makes a compelling case for the staying power of alternative carriers, which were responsible for only 4% of parcel deliveries in January 2020.

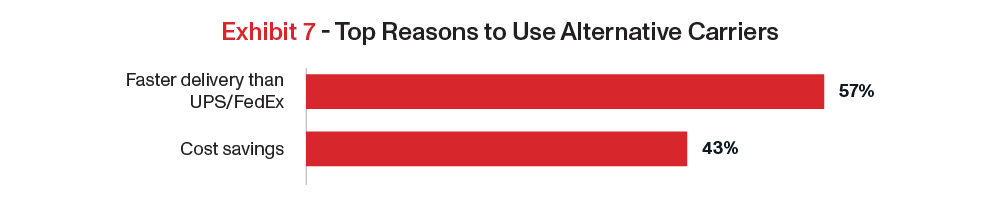

Exhibit 7 highlights why retailers use alternative carriers, with the majority citing cost-savings (57%) and faster delivery (43%) as the leading factors. Retailers also noted the influence of the quality of the delivery experience, on-time performance, and geographic coverage when deciding to work with alternative carriers.

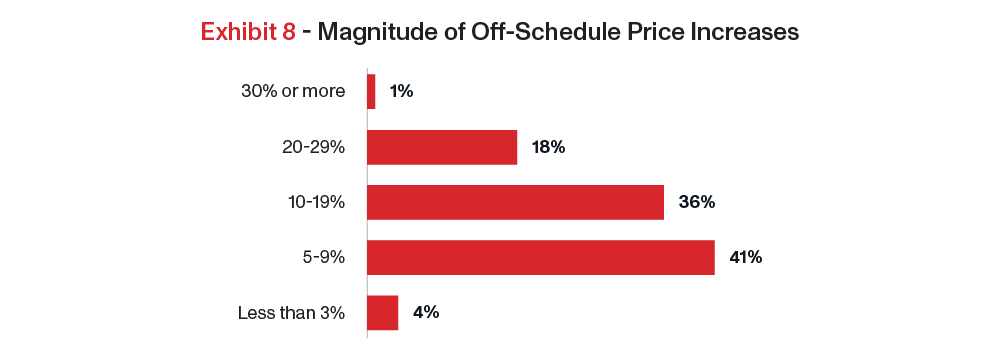

Alternative carriers have proven especially beneficial as retailers work to mitigate the impacts of rising costs. In the last year, 53% of retailers received an off-schedule price increase on top of general rate increases, with 77% of those price hikes falling between 5-19%, as shown in Exhibit 8.

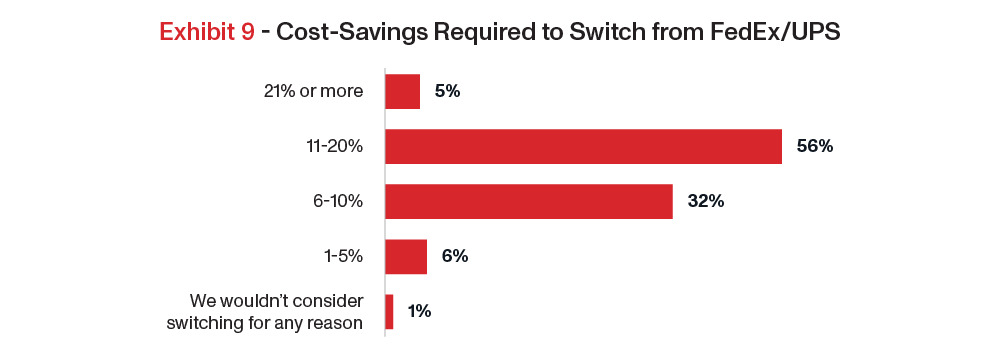

The duopoly has continued to raise costs, even as the carriers have been losing volume. Most recently, FedEx and UPS added surcharges ranging from $3.95 to $5.85 for deliveries in 82 ZIP codes, many of which cover parts of major urban areas. Retailers are more willing than ever to turn to alternative carriers in order to avoid such price hikes. Exhibit 9 shows that nearly 90% of retailers surveyed would switch from FedEx and UPS to get up to 20% cost-savings, up from 83% in 2023.

Carrier Consolidation is Already Happening

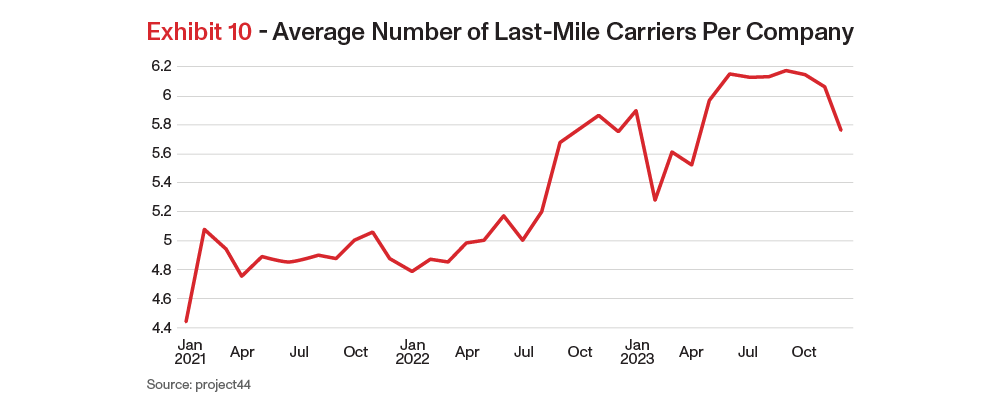

While Carrier diversification is here to stay, how retailers leverage it today to improve their shipping strategies is drastically different than three years ago. During the pandemic, carrier diversification became a necessity, and retailers could look to many different regional carriers that could provide faster delivery than UPS and FedEx, increased capacity, and lower shipping rates. However, conditions have changed over the last year and many retailers have over-diversified. Retailers on average used a record high of 6.17 last-mile delivery carriers in June 2023, as shown in Exhibit 10.

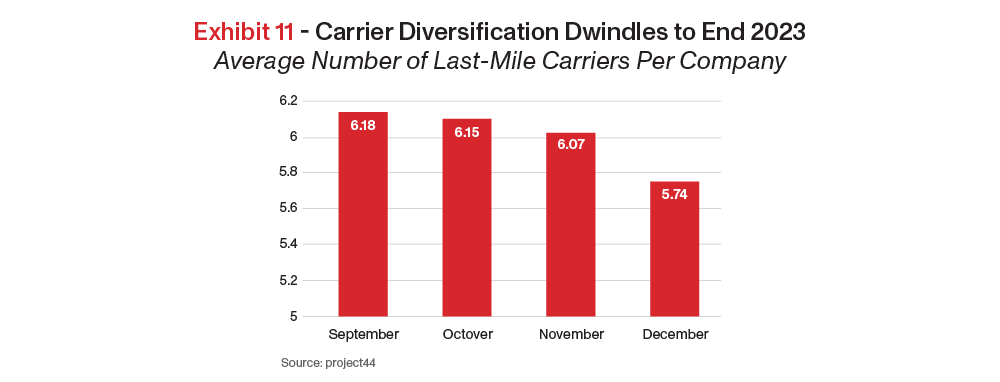

Retailers that have failed to consolidate their carrier mixes are struggling to balance multiple partners and losing out on opportunities for faster delivery and better pricing. Over-diversification is also causing constraints within the warehouse from sortation capability to available doors for carrier pickup. What’s next for carrier diversity? Carrier diversification dipped at the start of 2023, then the number of carriers shippers relied on spiked in June and July, as shippers prepared to mitigate supply chain disruptions from a potential UPS strike. Now that strike concerns have been alleviated, diversification is slowing down. Exhibit 11 reflects how number of carriers per company declined for three straight months at the end of 2023, dropping to 5.74 in December.

Carrier consolidation is already happening. Retailers on average are dropping around one carrier per month—and this theme is expected to continue. Capacity is no longer a concern due to softened delivery demand, and there is simply not enough volume to split up among multiple different carriers.

Retailers Have Already Implemented BOPIS and Click and Collect

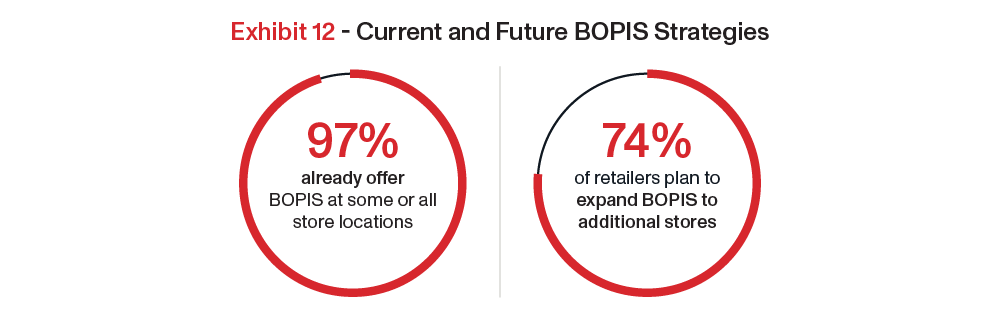

It’s no secret that buy online, pick up in-store (BOPIS) took off during the pandemic. Shippers adopted BOPIS and other forms of click and collect, including curbside pickup, in an effort to help offset rising logistics and last-mile delivery costs. Today, retailers continue to invest in BOPIS, even while 28% of consumers plan to decrease their use of this option. Nearly all retailers currently offer BOPIS from at least some store locations, with 74% planning to expand these options to additional stores, as shown in Exhibit 12.

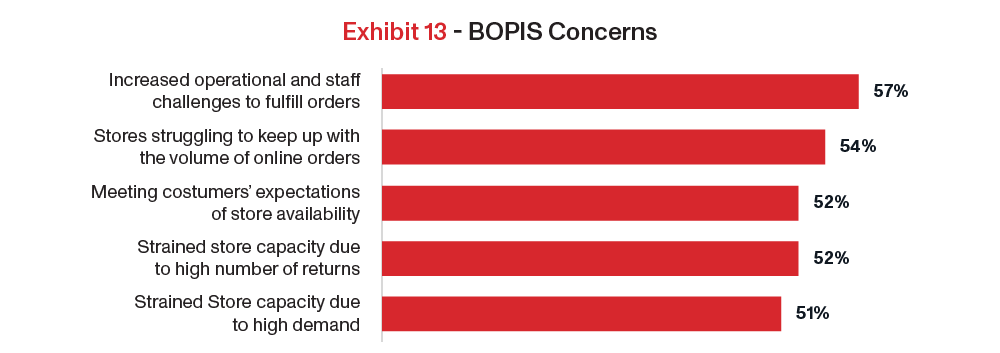

While there is no denying its growth, retailers are still struggling with a number of logistical and operational challenges related to BOPIS, largely stemming from the physical stores themselves. Exhibit 13 shows that over half of retailers are concerned about the impacts of BOPIS on store operations and staff. Consumers anticipate their BOPIS orders to be ready for pickup within a few hours after checkout, and any errors or delays during pickup can negatively affect customer satisfaction and loyalty. At the same time, many brick-and-mortar stores were not designed for fulfillment and pickup of online orders, and when inventory is not quickly available, retailers risk losing sales to competitors that can fulfill a consumers’ order more quickly.

To successfully implement BOPIS, retailers will need to invest in inventory management systems to get real-time stocking updates and merge online and in-store inventory tracking. Retailers must also communicate clearly with customers across multiple channels on how to best use click and collect in stores to ensure a seamless, efficient pickup experience, while minimizing wait times.

How can retailers respond to the ever-evolving e-commerce landscape and build flexible, adaptable supply chain strategies that empower them to win back customers and gain a competitive advantage?

Recommendations

- Win Customers with Faster Delivery

- Leverage Free Shipping and Home Delivery to Rebuild Brand Loyalty

- Consolidate Your Carrier Mix with the Right Carrier Partner

Win Customers with Faster Delivery

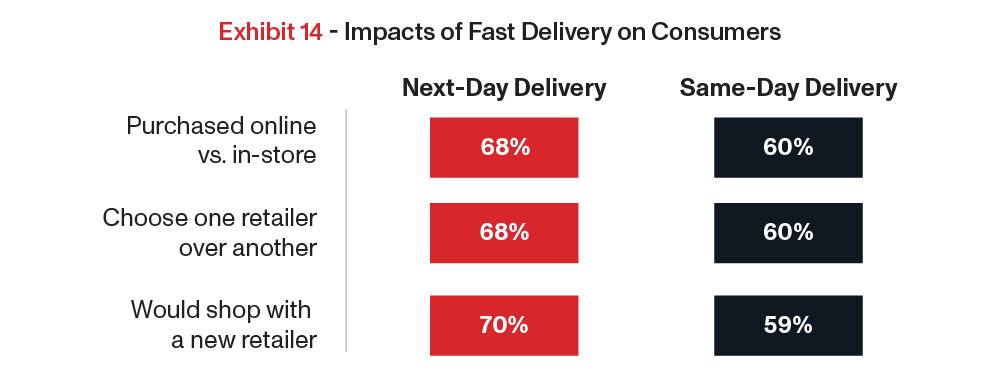

Consumers today want what they want, when they want it. In today’s instant gratification world, faster delivery is a key purchase driver that retailers can use to stand out from competitors, win new customers, and re-establish brand loyalty. This rings especially true for same-day and next-day delivery, which are increasingly driving consumers’ shopping decisions, as reflected in Exhibit 14. Speed also drives consumers to make future purchases, with 51% expressing they would shop again with a retailer that provides faster delivery.

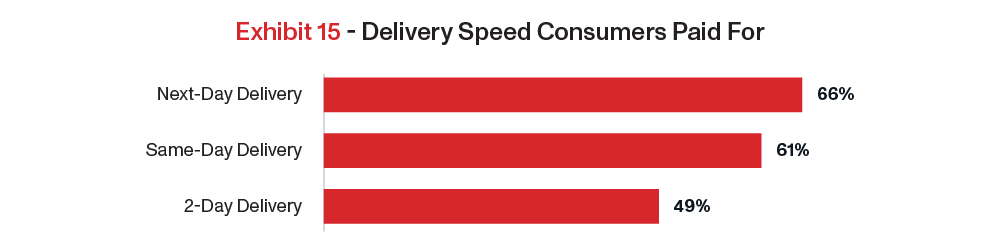

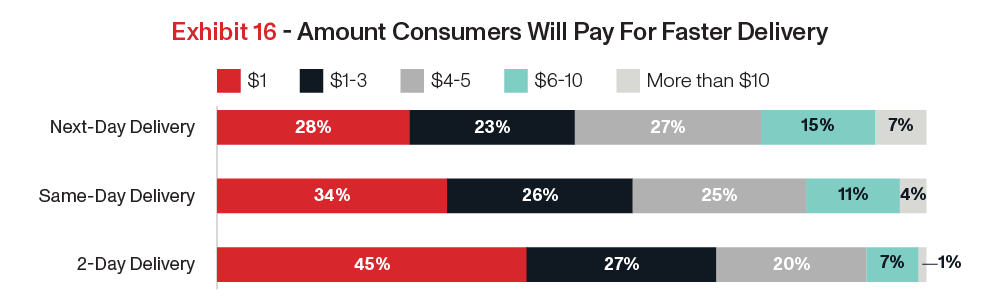

Not only has speed grown as a competitive differentiator, but consumers are paying for it more than ever. Over the last year, 52% of shoppers paid for faster delivery, with two-thirds having paid more for next-day (66%) and same-day (61%) delivery, as shown in Exhibit 15. When it comes to how much consumers will spend, Exhibit 16 shows that nearly half (49%) will pay at least $4 for same-day delivery.

Retailers that fail to invest accordingly stand to lose customers and fall behind the 64% of brands that plan to offer two-day delivery or faster in the next two years. Diversifying your carrier base with a proven alternative that can provide faster delivery options empowers you to acquire and retain more customers, while transforming your supply chain strategy into a competitive differentiator.

Leverage Free Shipping and Home Delivery to Rebuild Brand Loyalty

Consumers today are constantly researching and comparing brands before making a purchase, and they have shown that they have no problem switching to retailers that better meet their expectations.

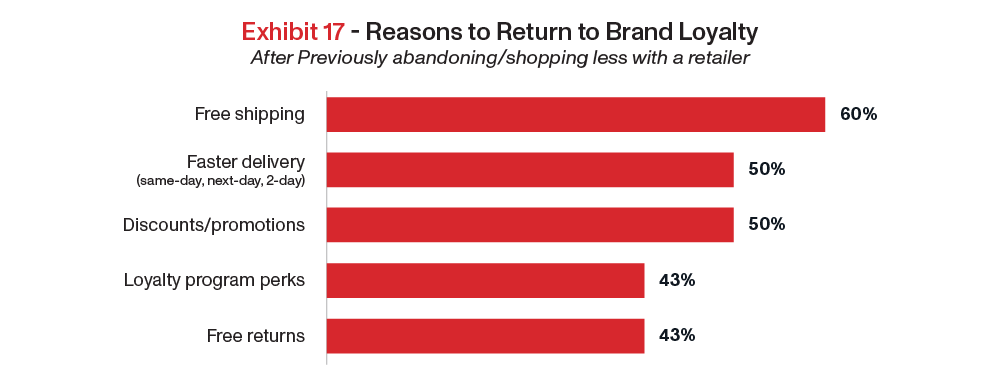

How can retailers win back customers and build lifetime value in a competitive, brand-agnostic climate? Along with fast delivery, consumers have made the answer clear: Prioritize free shipping and home delivery. Exhibit 17 highlights why consumers shop again with a retailer that they previously abandoned, naming free shipping as the leading factor.

Shipping cost also plays a critical role in driving customer loyalty. Sixty-four percent of consumers surveyed would purchase again from a retailer that provides free shipping, as shown in Exhibit 18.

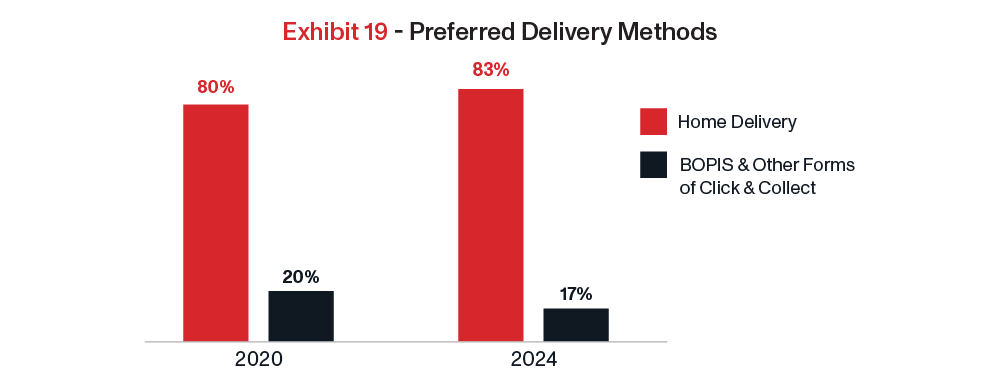

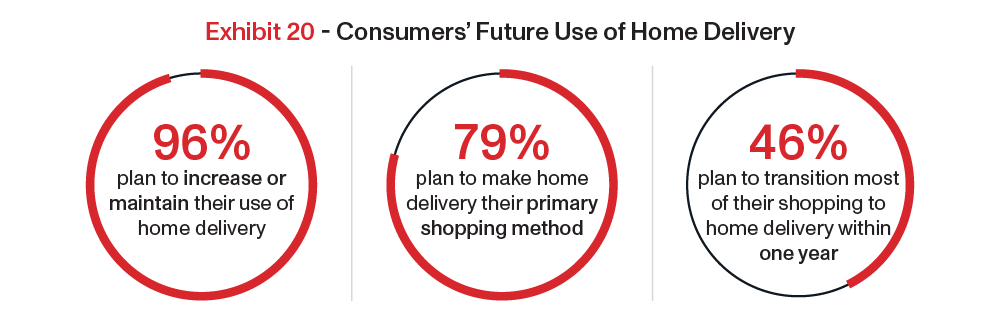

Along with free and fast delivery, answering consumers’ demands for convenience by providing home delivery is crucial to acquiring and retaining customers. Despite nearly all retailers offering BOPIS, consumers overwhelmingly prefer having orders delivered to their homes, as reflected in Exhibit 19. While BOPIS will continue to exist as an option, Exhibit 20 highlights consumers’ plans to increase their use of home delivery moving forward.

Continuing to invest in BOPIS while consumers decrease their use of this option and prioritize retailers that provide faster delivery simply does not make sense. Retailers that can provide free shipping and deliver products directly to their customers’ doorsteps more quickly will be well-positioned to build brand loyalty and gain a lasting edge over competitors, while also avoiding the operational problems and required investment that come with BOPIS.

Consolidate Your Carrier Mix with the Right Carrier Partner

The last-mile landscape and market conditions have evolved since the pandemic began. Since then, more carriers have entered the market and demand has not kept up with supply. Carrier diversification today is a matter of quality over quantity. Continued economic uncertainty has led to lower retail sales and e-commerce volumes, and in turn, forced retailers to go back to the table and look at over-diversification as a problem. Shippers should now be looking at a two to three carrier solution, rather than five or more options. Not all carriers are created equal, and retailers need to be strategic when choosing a partner. How can shippers choose the right carrier partner in a saturated market where supply exceeds demand? When evaluating potential carriers, it is imperative that shippers determine their goals, analyze the data, and prioritize service and partnership. Retailers should choose a proven alternative carrier that can provide the best combination of the following factors:

- Speed: In today’s instant gratification economy, consumers are increasingly choosing retailers that provide faster delivery. Retailers should choose a carrier that can meet consumers’ growing demands for faster delivery in order to remain competitive.

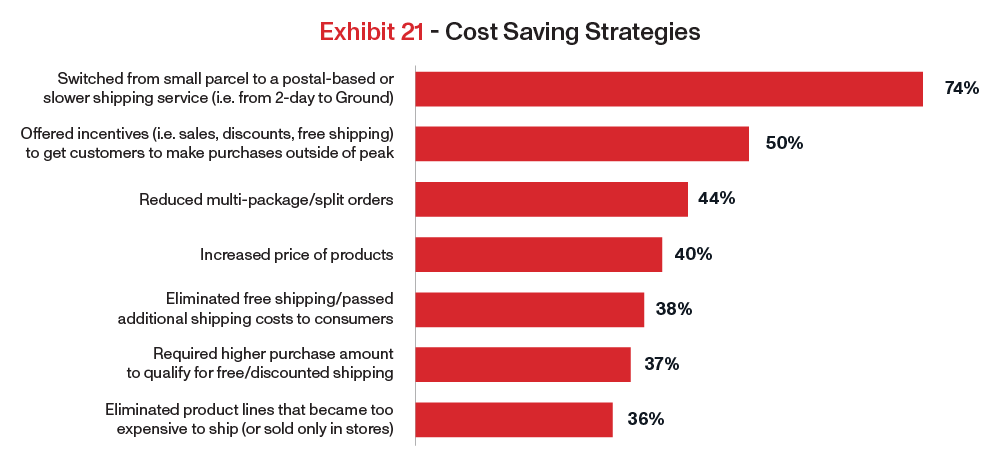

- Cost Savings: Retailers should look for a carrier that can offer the most cost-effective options to help them reach their customers. Too many retailers have compromised the delivery experience to compensate for rising costs, with 74% opting for slower shipping, despite consumers’ demands for faster delivery (Exhibit 21).

- Service: Cost is important but shouldn’t be the only consideration. Retailers should carefully examine the service offerings and have conversations to understand if a potential partner’s solution fits their needs. A strong on-time performance record is critical, as well as an innovative tracking experience to make sure customers are satisfied.

- Network Coverage: Nearly half (46%) of retailers cite limited delivery area as the greatest downside to using alternative carriers. Partnering with a carrier that can provide the greatest amount of geographic coverage will prevent retailers from having to onboard multiple carriers to reach their customers in different locations.

- Delivery Innovation: Carriers that are investing in their networks and technology to improve the consumer experience should be a key focus for shippers.

- Experience: A reliable, proven carrier with experience, expertise, and infrastructure can help retailers keep up with the evolving e-commerce delivery landscape.

Shippers that move away from reliance on the duopoly and diversify their carrier mixes with a proven alternative can set themselves apart from their competitors. Retailers should be intentional in choosing a long-term partner that meets their needs and can help them reach their goals. The right carriers will be transparent, flexible, and long-term partners who are committed to a retailer’s success.

As e-commerce continues to grow, faster delivery will continue to grow its influence as a key purchase driver and competitive differentiating tool. Retailers that fail to answer consumer demands for speed and convenience and keep up with new industry trends will lose business and fall behind. Shippers should move away from reliance on the duopoly and diversify their carrier mixes with a proven alternative that can help them stand out from the competition. Retailers should act now to partner with a proven alternative that empowers them to provide faster, free home delivery that builds brand loyalty, while increasing supply chain flexibility and protecting their margins with lower costs.

About the Author

An industry veteran with over 20 years of experience, Josh Dinneen is the Chief Commercial Officer at OnTrac, the carrier of choice for last-mile, e-commerce parcel delivery, where he oversees revenue strategy, sales, marketing, account management, and call center operations. Josh has spearheaded the company’s transcontinental delivery service launch, which provides faster, cost-effective, coast-to-coast delivery to leading shippers and retailers. Prior to his current role, Josh created LaserShip’s e-commerce hub and spoke delivery network as the Vice President of Supply Chain.

About OnTrac

OnTrac is the parcel carrier of choice for last-mile e-commerce deliveries that helps retailers and shippers build a competitive advantage through faster delivery times, lower costs, coast-to-coast coverage, and reliable on-time performance. The OnTrac delivery network reaches approximately 85% of the U.S. population in 35 states and Washington, D.C. and enhances retailers’ ability to meet growing demand in the consumer e-commerce delivery market. With more than 65 years of experience, OnTrac has evolved into a critical part of the e-commerce infrastructure and is trusted by leading retailers and shippers that desire reduced transit times and increased flexibility within their supply chains.